The Shadow Supply Chain: How Illegal Chinese Vapes Flood the U.S. Market

The United States is currently facing a flood of unauthorized, often flavored, disposable e-cigarettes, with the vast majority originating from manufacturing hubs in China. Despite a regulatory framework designed to control the market and protect youth, a complex and often brazen supply chain has emerged, leveraging a network of U.S.-based middlemen – including customs brokers and obscure distribution companies – to navigate import hurdles and place these illegal products onto store shelves nationwide. A deep dive into customs data, regulatory filings, and industry insights reveals a shadow economy operating in plain sight, posing significant challenges for federal enforcement agencies and public health officials alike.

The Scale of the Problem: A Tale of Two Datasets

The sheer scale of the illicit vape trade is staggering, highlighted by a massive discrepancy in international trade data. In 2024, Chinese customs data reported that China exported more than 26 billion yuan (approximately $3.6 billion) worth of vapes to the United States. However, U.S. customs figures for that same year show only $333 million in Chinese vapes were officially received. This 90% gap, which customs data specialists described to Reuters as unusual, points to a vast, undeclared flow of goods.

This discrepancy is largely explained by widespread mislabeling and disguise. According to the U.S. Food and Drug Administration (FDA), which leads efforts to control the vape market, unauthorized vapes often arrive in the U.S. concealed in shipments declared as other items, such as “shoes,” “toys,” or other consumer goods, to evade detection and tariffs.

The Role of the Middlemen: Customs Brokers

At the heart of this import process are customs brokers, firms licensed to help importers navigate the complex web of customs documentation and regulations. While they don’t buy or sell goods themselves, their role is critical in getting shipments cleared by border officials. An analysis by Reuters of FDA data revealed that one small firm, a customs brokerage run by a man named Jay Kim from an office near Chicago’s O’Hare International Airport, played an outsized role in this trade. In 2024 alone, Kim’s firm handled a remarkable 60% of all registered shipments of vapes and vape parts from China to the U.S.

In an interview in April, Kim initially claimed that “a lot of them have FDA authorization,” referring to the vape shipments his firm handled. However, a review of the FDA’s own import data showed that the products his firm helped bring into the United States included major unauthorized brands like Lost Mary and Geek Bar. The FDA has explicitly declared these brands illegal to import or sell, warning their array of fruit and candy flavors may appeal to children and that nicotine can harm developing brains.

Customs brokers can face legal jeopardy if they are found to have not conducted proper due diligence on the shipments they process. Speaking briefly to Reuters, Kim later stated his firm had exited the vape business last year, attributing his involvement to a former employee who took those clients with her when she left. However, the FDA data reviewed by Reuters showed that vape-related shipments handled by Kim’s firm have continued throughout 2025, including as recently as June.

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

18K Disposable Pod Kit

Disposable Pod Kit – 18ml changeable pod with 650mAh rechargeable battery.

20K with Large Screen

20000 Puffs Disposable Vape with large screen. Normal and Boost working modes.

30K DTL Disposable

30K Puffs DTL(Directly to Lung) disposable vape with airflow control and screen.

The Importers: A Network of Obscure and Untraceable Firms

Once a vape shipment clears U.S. customs, it is passed along to its U.S. buyer – typically a distributor, which then sells the products to smaller wholesalers and retailers across the country. An analysis of the FDA’s data on the recipients of these shipments reveals another layer of the shadow supply chain.

While the largest recipient in 2024 was Reynolds American, the U.S. subsidiary of British American Tobacco (BAT), the top ten list also included six obscure firms. These companies were often recently established (in 2023 or 2024), sometimes registered to residential homes, and proved difficult to trace. For example, the second-largest recipient of vape shipments in 2024 was a Chicago-based company called Somo Trade LLC, established in 2023 and registered to a residential home. Another recipient, Rongda Trade, was registered to a house on the same street, opened in the same month, and has already been shut down. Reuters could not find websites or contact information for many of these firms, and visits to their registered addresses often led to dead ends.

This pattern of using newly formed, hard-to-trace companies as importers appears to be a deliberate strategy to obscure the flow of goods. This was highlighted in a February lawsuit by New York Attorney General Letitia James against 13 different companies she identified as major U.S. vape distributors, accusing them of working closely with Chinese manufacturers to fuel the unauthorized vape industry. The complaint stated, “Together, Defendants have established an industry for flavored e-cigarettes, particularly disposable vapes, and staked out their own lucrative shares in the soaring market.”

The Federal Response: A Renewed Push for Enforcement

Faced with this flood of illegal products, the Trump administration has promised a renewed crackdown. FDA Commissioner Marty Makary has stated the agency will stop illegal imports and distribution, and Secretary of Health and Human Services Robert F. Kennedy Jr. told a Senate committee in May that the administration would “wipe out” the fruity and sweet flavored vapes from China that appeal to kids. “We are going to get rid of all of them,” he said.

The FDA and U.S. Customs and Border Protection (CBP) are part of a federal task force focused on e-cigarette enforcement. Recent actions demonstrate this intensified effort:

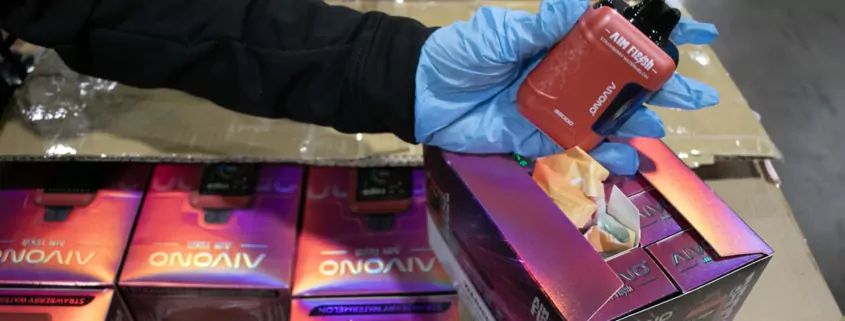

- In May, the agencies announced a $34 million seizure of unauthorized vapes in Chicago from an operation conducted in February. Officials noted many of the shipments contained vague product descriptions and incorrect values.

- As part of this operation, for the first time, the FDA sent informational letters to 24 middlemen, including U.S. importers and customs brokers, warning them that making false statements to the government is a crime and requesting information on their compliance procedures.

These actions follow other major seizures, including $76 million in illegal vapes by CBP in 2024 and a combined FDA-CBP total of over $136 million in seized e-cigarettes over the past two years.

The Blame Game and Ongoing Challenges

Despite these enforcement actions, critics argue that the FDA has been too slow to act. Illinois Congressman Raja Krishnamoorthi laid most of the blame with the agency, which he accused of sitting idle while illegal vapes flooded the country. “The FDA is a disaster. It’s asleep at the switch,” he said. “You have illicit vapes all over the place.”

Mitch Zeller, the former head of the FDA’s Center for Tobacco Products under three administrations, placed the blame more squarely on the U.S.-based distributors. “There’s only a handful of middlemen, middle companies, that are responsible for taking the illegal, imported stuff being misclassified and mislabeled and getting it into interstate commerce,” he said. This highlights the critical role these domestic players have in completing the illicit supply chain.

The market reality is that despite the FDA having authorized only 34 different vape products (all tobacco-flavored, from companies like BAT and Altria), unauthorized devices are estimated by BAT executives to make up 70% of vape sales in the U.S., with a value of $8.14 billion last year. The rise of brands like Geek Bar continues to erode the market share of companies selling legal, authorized products.

ECIGATOR

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

Market Impact and an Adaptable Industry

The combination of the Trump administration’s tariffs on China and the recent vape seizures is beginning to have a tangible impact on the supply chain. Reuters reported this month that these pressures have led to a collapse in officially recorded vape shipments in May, causing a shortage of popular brands like Geek Bar and leading to some panic-buying among distributors and consumers.

However, the industry has proven to be extremely resilient and adaptable. To circumvent tariffs and enforcement focused on China, some unlicensed e-cigarette production has already reportedly shifted to other countries, such as Indonesia. This trend is likely to accelerate if pressure on Chinese imports remains high.

As one former employee of a major Chinese e-cigarette company stated, “The e-cigarette industry is extremely adaptable. No matter what happens in the U.S., the industry will survive.” This sentiment captures the immense challenge facing U.S. regulators. While seizures and tariffs can disrupt specific supply routes and players, the underlying global manufacturing network and the strong U.S. consumer demand for these products mean that the battle to control the flow of illegal vapes is likely to be a long and evolving one, a high-stakes game of cat and mouse played out at ports, in warehouses, and on store shelves across the country.

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025

- Vaping vs. THC Drinks: Which Cannabis Option Is Right for You? - August 4, 2025

- Colombia’s New Vape Law: A Reality Check on Enforcement - August 4, 2025