The complex web of international trade significantly influences the global vaping market, particularly the relationship between the United States and China. China stands as the dominant manufacturing powerhouse for the vast majority of vape hardware—devices, pods, coils, batteries—that fill the shelves of American vape shops and convenience stores. However, recent dramatic escalations in US trade policy have imposed tariffs on these crucial imports that soar past the 100% mark, creating a seismic shockwave felt throughout the supply chain and ultimately, by consumers at the checkout counter. While the exact tariff percentage became a moving target during its rapid implementation in mid-2025, with figures reported as high as 170%, the fundamental reality is clear: any tariff substantially exceeding 50% acts as a formidable economic barrier, fundamentally altering the dynamics of trade. This guide delves into the implications of this extreme tariff environment, exploring what it means for vaping industry professionals in both the US and China, and how it directly impacts the choices and costs facing American consumers.

Read moreA coalition representing 24 shopkeepers from major UK convenience groups like Premier, Londis, and Nisa has issued an urgent public appeal for talks with the government, warning the proposed Tobacco and Vapes Bill could force them to “close for good.” They argue the legislation risks “suffocating the backbone of the local community” if implemented without considering its real-world impact on small businesses.

Read moreUK retailers are on the cusp of significant legislative changes impacting tobacco and vape sales. The Tobacco and Vapes Bill, having cleared the House of Commons and now undergoing scrutiny in the House of Lords, introduces two landmark measures: a ‘generational smoking ban’ (GSB) and a complete ban on disposable (single-use) vapes.

Read moreIn the wake of Utah’s ban on flavored vape products, many residents are finding themselves crossing state lines to purchase their preferred nicotine brands. The Juicity Vapor shop in Evanston, Wyoming, has seen a significant influx of Utah customers, with cars from various counties like Weber, Utah, and Sanpete pulling into the parking lot.

Read moreA new report warns that Labour leader Keir Starmer’s proposed Tobacco and Vapes Bill could result in the closure of approximately 7,700 corner shops and off licences, impacting 70,000 jobs across the UK.

Read moreBreakdown of layered US tariffs (Sec 301, IEEPA, Reciprocal) leading to 79% tax on vape imports from China; market impact explored.

Read moreThe countdown to the ban on single-use vapes in the UK has begun, with high street shops and convenience stores being encouraged to sell their remaining stock before the June 1, 2025 deadline. The legislation, which was laid in parliament last year following a government consultation that showed overwhelming support for restricting the sale and supply of these products, aims to address the growing environmental and public health concerns associated with single-use vapes.

Read moreAs of April 1/2025, retailers in Belgium are no longer allowed to display tobacco products at points of sale, following an amendment to the consumer health protection law of January 24, 1977. The ban encompasses cigarettes, cigars, rolling papers, water pipe tobacco, and e-cigarettes, and prohibits the sale of these products in food stores larger than 400 square meters.

Read moreAs of 1/4/2025, Malaysia has put into effect a prohibition on displaying smoking products at point of sale counters, in accordance with Regulation 6 of the Control of Smoking Products for Public Health (Sales Control) Regulations 2024. This move follows the enforcement of the Control of Smoking Products for Public Health Act 2024 (Act 852) and its related regulations and orders, which came into effect on October 1 of the previous year.

Read moreAs of April 1, 2025, Spain has implemented a new tax on vaping products, aiming to align the taxation of these items with that of traditional tobacco products. This measure, part of a broader tax reform outlined in Law 7/2024, is set to have a significant impact on consumers and the vaping industry as a whole.

Understanding the New Tax Structure

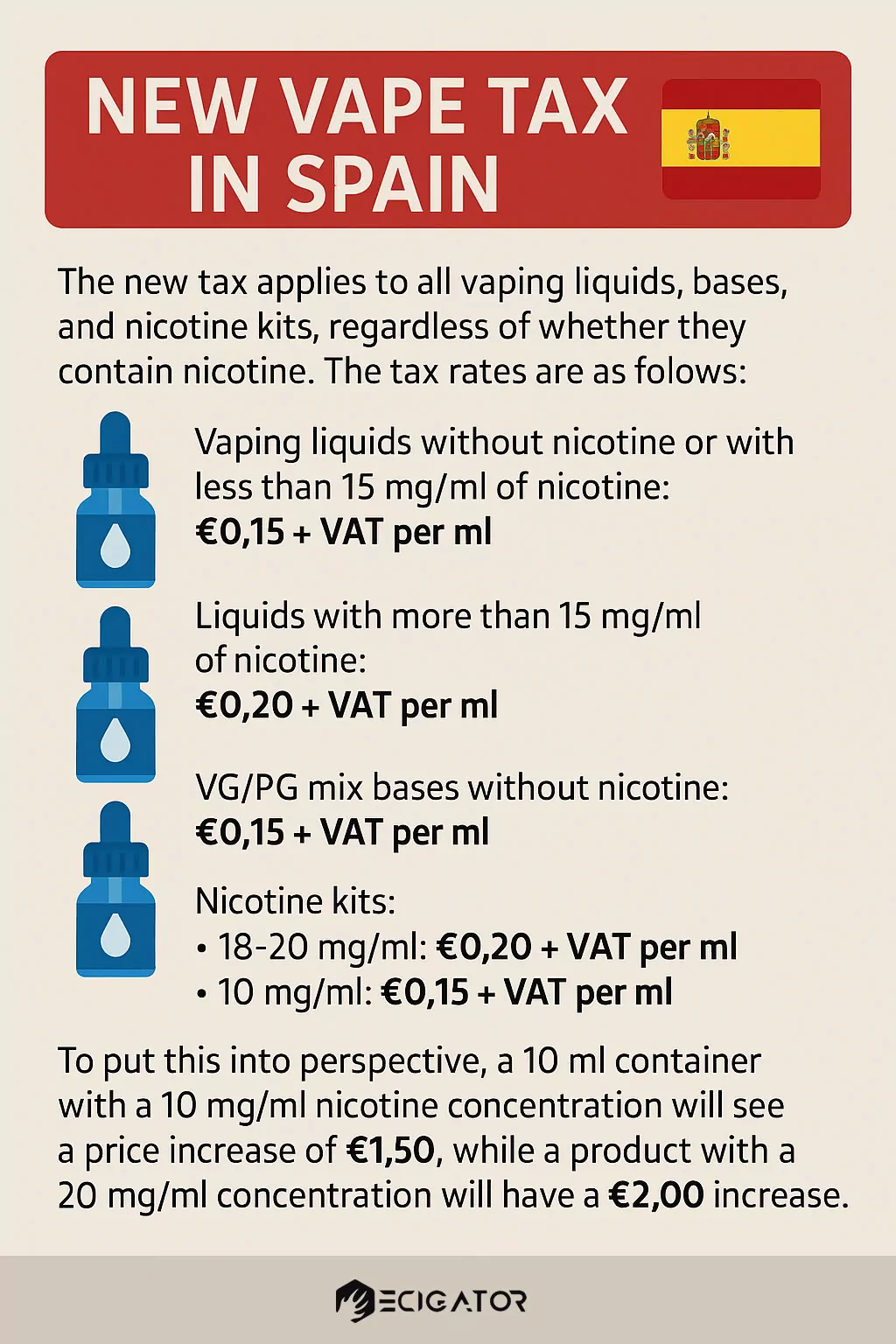

The new tax applies to all vaping liquids, bases, and nicotine kits, regardless of whether they contain nicotine. The tax rates are as follows:

- Vaping liquids without nicotine or with less than 15 mg/ml of nicotine: €0.15 + VAT per ml

- Liquids with more than 15 mg/ml of nicotine: €0.20 + VAT per ml

- VG/PG mix bases without nicotine: €0.15 + VAT per ml

- Nicotine kits:

- 18-20 mg/ml: €0.20 + VAT per ml

- 10 mg/ml: €0.15 + VAT per ml

To put this into perspective, a 10 ml container with a 10 mg/ml nicotine concentration will see a price increase of €1.50, while a product with a 20 mg/ml concentration will have a €2.00 increase.

The Impact on Consumers

The new tax will lead to significant price increases across various vaping products:

- 100 ml nicotine-free shortfill: +€18.15 including VAT

- 50 ml nicotine-free shortfill: +€9.08 including VAT

- 10 ml liquids: An increase between +€1.81 and +€2.42 including VAT

- Nicotine kits: Prices will approximately triple, with an increase of +€2.42 including VAT

- PG/VG mix bases without nicotine (1 liter): If the tax applies to these bases, the current price could increase by 14 times, adding +€181.15 in VAT and taxes

These price hikes will not only affect occasional vapers but also those who rely on vaping as a tool to quit smoking. Many consumers may find themselves exploring alternatives or turning to the unregulated market, which can pose significant health risks.

Adapting to the New Landscape

In light of these changes, consumers will need to be proactive in adapting to the new vaping landscape. Some strategies to consider include:

- Making purchases before the tax takes effect: If you have the means, stocking up on your preferred products before April 1 can help you save money in the short term.

- Opting for aromas and longfills: These formats, which allow you to create your own liquids, are not subject to the new tax. They may become more popular among vapers looking to save money while still enjoying their preferred flavors.

- Choosing 100% PG or 100% VG bases: As these bases are not suitable for vaping on their own, they are not subject to the new tax. Mixing your own liquids using these bases can be a more cost-effective option.

- Avoiding the illegal market: While it may be tempting to turn to unregulated sources for cheaper products, doing so can expose you to significant health risks. Stick to reputable, legal vendors to ensure the safety and quality of your vaping products.

The Future of Vaping in Spain

The introduction of this new tax marks a significant shift in Spain’s vaping industry. Specialized stores will need to adjust their offerings, potentially removing heavily taxed products like shortfills and promoting more affordable options like aromas and longfills.

It remains to be seen how consumers will respond to these changes in the long term. Some may choose to quit vaping altogether, while others may find ways to adapt and continue enjoying their preferred products.

As a consumer, staying informed about these changes and making smart, health-conscious choices will be crucial in navigating this new landscape. By understanding the tax structure, exploring alternatives, and supporting reputable vendors, you can continue to enjoy vaping while minimizing the financial impact of the new tax.