Vape and Oral Nicotine Categories Undergo Significant Shifts in C-Store Channel

Industry Faces Challenges with Illegal Products, Favors Disposables, 0% Nicotine, and Modern Oral

As the vape and oral nicotine categories continue to evolve in the convenience store (c-store) channel, retailers are grappling with the impact of illegal products, shifting consumer preferences, and regulatory developments. Industry experts predict that 2025 may bring further regulatory clarity as the Center for Tobacco Products reviews premarket tobacco product applications (PMTAs) and intensifies enforcement efforts against illegal vape products.

David Spross, executive director of the National Association of Tobacco Outlets (NATO), anticipates continued attempts to ban flavors at the state level, primarily in the Northeast and on the Pacific Coast, along with potential excise tax increases in 10-15 states. However, the election of President Donald Trump has sparked hope for a more favorable regulatory environment for flavored vapor products and nicotine pouches.

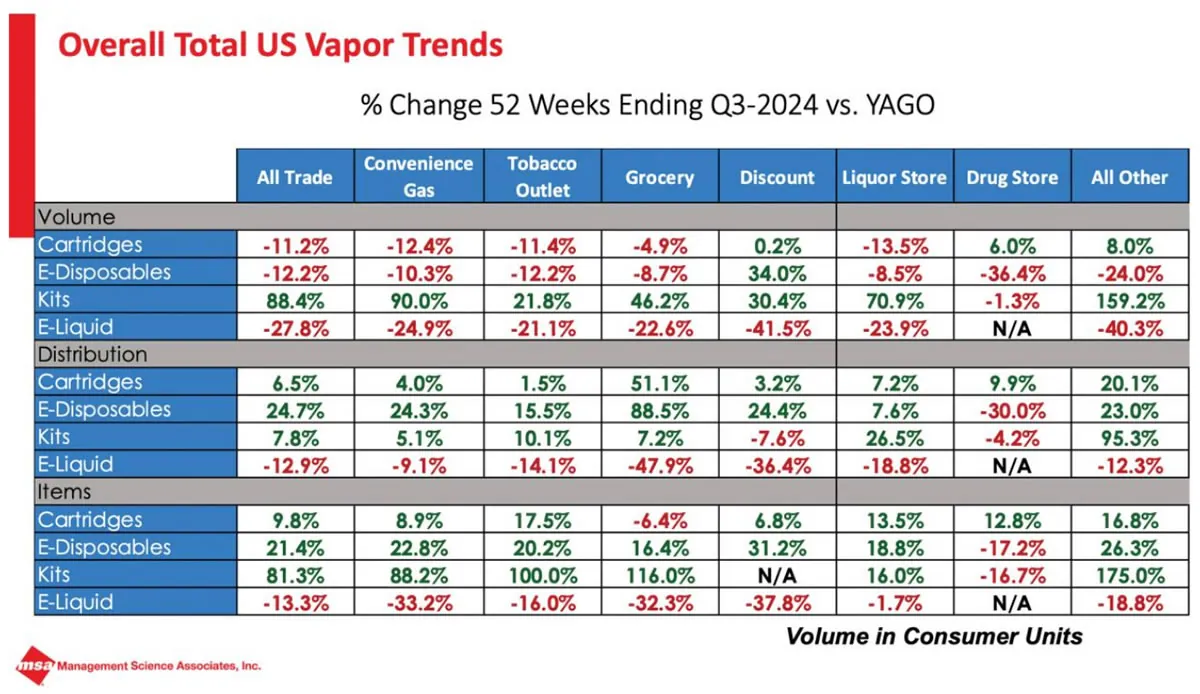

Illegal Vape Products Skew Category Performance

Despite estimated declines in total U.S. vape shipments and c-store sales, industry experts believe that disposable vape sales are actually growing across all classes of trade. Don Burke, senior vice president of Management Science Associates (MSA), notes that some independent retailers are likely selling illegally imported disposables from China, which are not captured in tracked data.

In response to the illegal distribution and sale of e-cigarettes, the Department of Justice and the Food and Drug Administration (FDA) formed a federal multiagency task force in June. NATO reports that the FDA and Customs and Border Protection seized approximately 3 million unauthorized e-cigarette products, with a combined estimated retail value of $76 million, in October.

Disposables and 0% Nicotine Emerge as Key Trends

Regulations and health-conscious consumers are driving trends in the vape segment. Disposable vape products, which can legally contain flavors, have gained popularity over cartridges. Manufacturers are creating large disposable products with thousands of puffs, lasting as long as several packs of cigarettes.

Another emerging trend is the rise of 0% nicotine disposables, which grew by triple digits in Q3 2024 compared to the previous year, according to MSA. These products may appeal to consumers looking to quit their nicotine habit while still enjoying the hand activity and mouthfeel associated with vaping.

Modern Oral Experiences Significant Growth

In the evolving nicotine landscape, modern oral and snus have emerged as notable players. The FDA recently renewed modified risk granted orders for eight Swedish Match snus products through 2032, allowing them to be marketed with reduced risk claims compared to cigarettes.

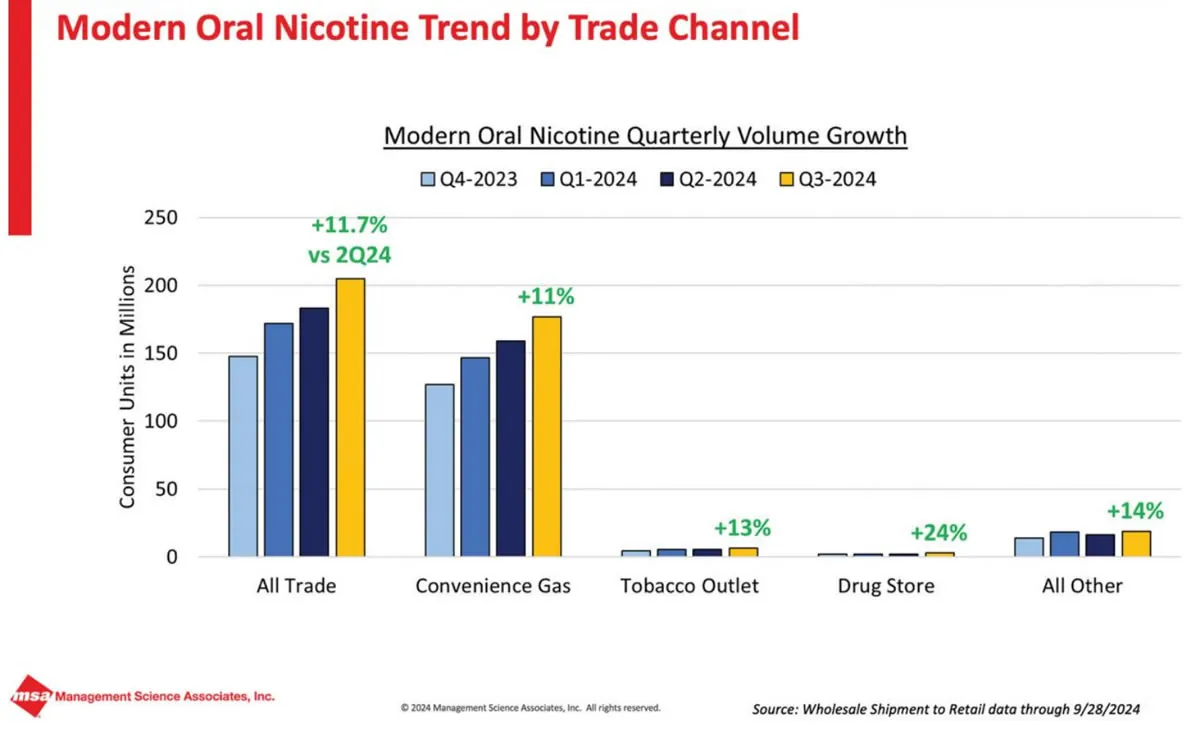

The overall oral category, including moist, snus, and modern oral, is projected to see 9-11% growth in wholesale shipments to retail in 2024, largely driven by modern oral products. Modern oral nicotine volume in the c-store channel was up 11% in Q3 2024 compared to Q2, outpacing sales in other channels like tobacco outlets and drug stores.

Don Burke highlights that repeat purchases are becoming more important to the modern oral category, with same-store sales growing by 11.7% in the most recent quarter. When seeking a nicotine product in Q3, customers selected a non-combustible product 34.5% of the time, up 4.1 points from the previous year. Remarkably, nearly 18% of nicotine shoppers chose a non-tobacco product.

Modern oral has grown significantly, now outpacing vape in terms of consumer units sold and ranking as the third most popular item in the entire tobacco category, with a 55% increase in Q3 2024 compared to the previous year.

As the vape and oral nicotine categories continue to evolve, c-store retailers must stay informed about regulatory developments, consumer preferences, and emerging trends to effectively navigate this dynamic landscape.

- Malaysia Negeri Sembilan Backs Vape Ban, Awaits Clear Laws - August 5, 2025

- Is It Illegal to Vape or Smoke While Driving in Massachusetts? - August 5, 2025

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025