US Tariffs & Crackdown Hit China Vape Imports Hard

The flow of e-cigarettes from China into the United States, the world’s largest vaping market, has dramatically slowed, with official import data showing a near halt in May 2025. This sharp decline is attributed to a combination of new U.S. tariffs imposed under the Trump administration and intensified crackdowns on unlicensed and illegal e-cigarette products. While this aims to curb the influx of unauthorized items, particularly popular disposable flavored vapes, industry insiders anticipate price hikes for consumers and a resilient, adaptable black market that will continue to find ways to supply demand.

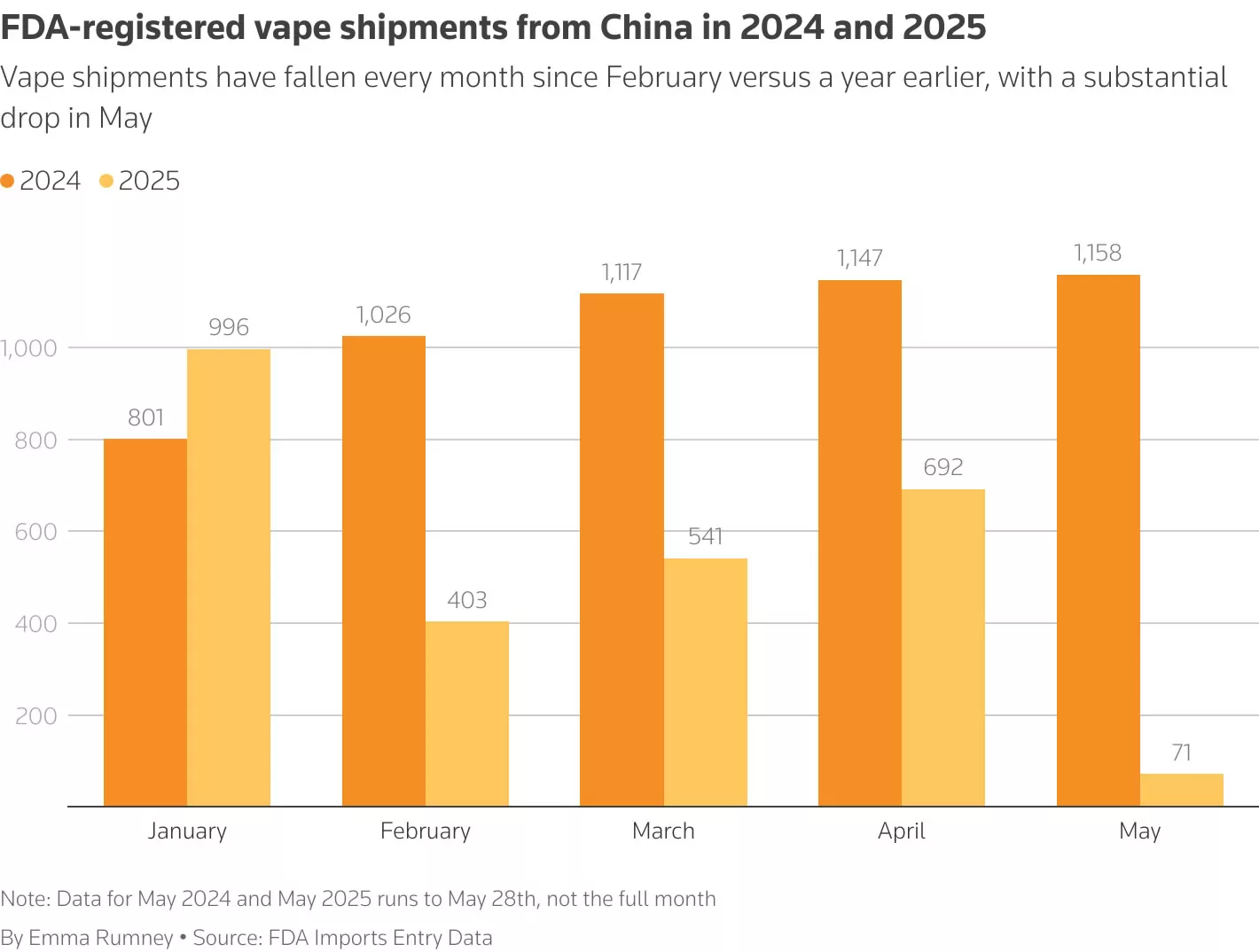

According to U.S. Food and Drug Administration (FDA) data, only 71 shipments declared as “electronic cigarettes” or “vapes” were imported between May 1 and May 28, a stark drop from approximately 1,200 in the same period last year. Since President Trump returned to power, imports reportedly fell by 40-60% between February and April before virtually stopping in May. These measures have severely impacted Chinese manufacturers, including those producing popular but FDA-unauthorized brands like Geekbar, made by Qisi Intelligent Manufacturing.

Retailers and wholesalers are feeling the squeeze. One retailer reported a wholesaler’s weekly purchase of Geek Bars dropping from 100 boxes to just 10, while others are limiting purchase quantities for the first time, citing higher prices and reduced supplies due to tariffs. President Trump initially raised tariffs on certain Chinese goods, including e-cigarettes, to 145% in April before adjusting them to 30%. Alongside these tariffs, mass seizures of illegal e-cigarettes have further constricted supply.

Despite the supply crunch, U.S. e-cigarette distributors largely agree that while prices are set to rise, nicotine-addicted consumers are likely to continue purchasing. “Customers will still buy them even if the price goes up, because it’s a nicotine product,” one distributor commented, suggesting that even a \$5 increase on a \$20 Geek Bar would still be considered “a great deal” by many. Luis Pinto, communications director for the U.S. subsidiary of British American Tobacco (BAT), acknowledged that tariffs would increase prices but doubted they would be sufficient to significantly discourage use, especially given the high profit margins on many unlicensed e-cigarettes which might allow vendors to absorb some of the tariff costs.

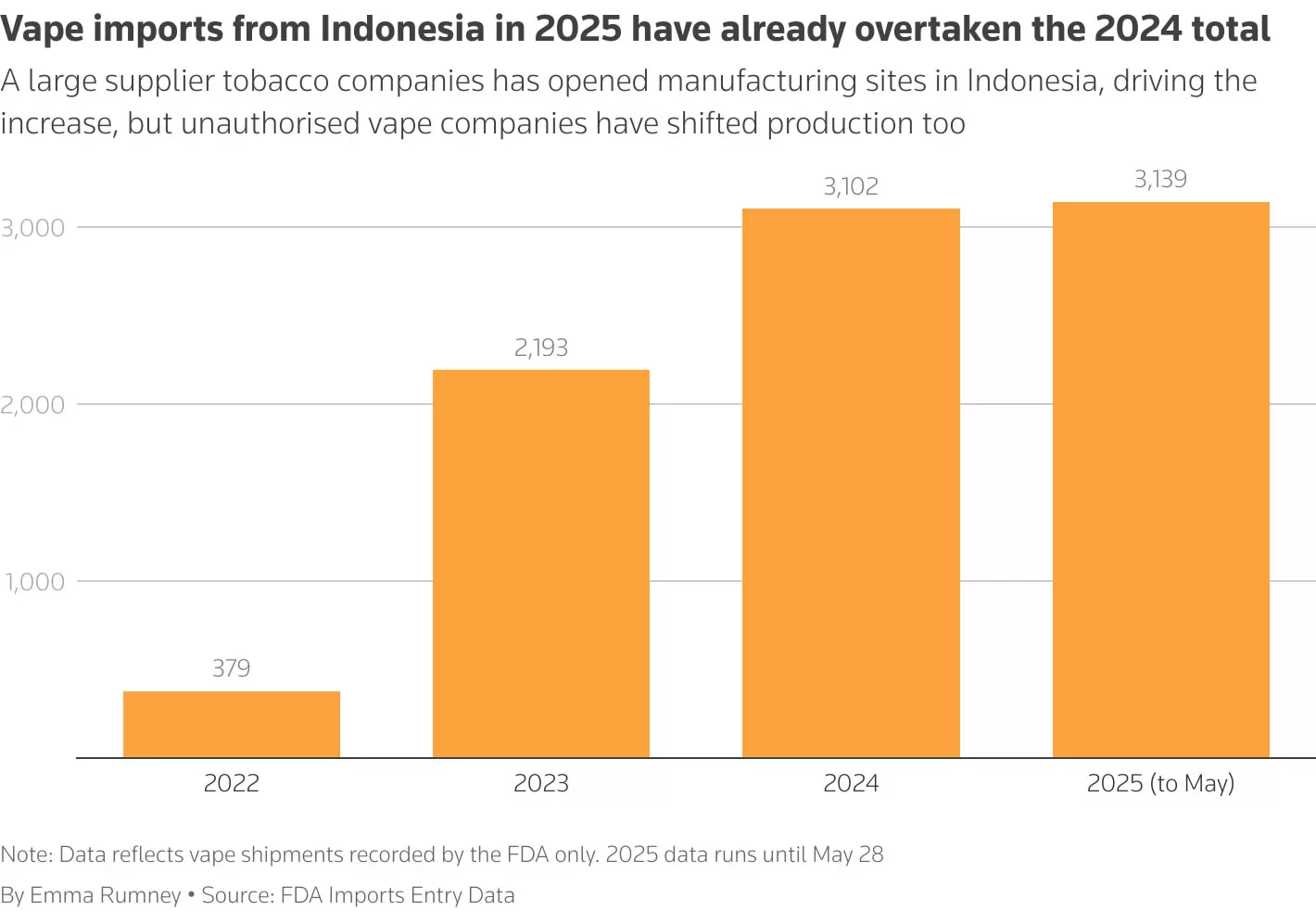

The crackdown has also spurred panic-buying in some segments of the U.S. market, increasing shipping costs and making border crossings riskier for illicit products. The FDA announced a large-scale seizure of unlicensed e-cigarettes in Chicago in February and has vowed to step up enforcement under its new leadership. However, illegal e-cigarette manufacturers are reportedly employing various tactics to circumvent regulations and tariffs, such as misrepresenting shipment contents (e.g., as “shoes” or “toys”), under-declaring values, or falsely claiming their products originate from countries like Indonesia, Vietnam, or Mexico.

Even with increased enforcement, BAT estimates that unauthorized products will still account for about 70% of the U.S. e-cigarette market in 2024, with brands like Geek Bar eroding the market share of major tobacco companies that sell FDA-authorized products. Interestingly, FDA import data has shown declining volumes since 2020 (as it only records properly declared shipments), even as actual industry-wide sales have increased, indicating the scale of the undeclared or mislabeled illicit trade.

The industry’s adaptability is a key factor. Some unlicensed e-cigarette production has already reportedly shifted from China to countries like Indonesia, a trend expected to accelerate if tariffs on Chinese products remain high. As one former employee of a major Chinese e-cigarette company stated, “The e-cigarette industry is extremely adaptable. No matter what happens in the U.S., the industry will survive.” This suggests that while current measures may disrupt established supply chains and raise prices, the underlying demand and the global nature of manufacturing will likely lead to new avenues for both legal and illicit products to reach consumers.

- News source: US faces vape shortage as China tariffs