Australia’s High Tobacco Tax Fuels Black Market, NSW Cracks Down

As New South Wales (NSW) prepares to implement some of the nation’s toughest laws against the illicit tobacco trade, a broader debate is intensifying over whether Australia’s high tobacco taxes are inadvertently fueling a dangerous black market. The illicit trade has been linked to gang violence, robberies, and arson attacks, prompting a significant legislative and enforcement response.

NSW Premier Chris Minns has announced new, stricter regulations, including a new offense for the “commercial possession of illegal tobacco,” carrying maximum penalties of up to seven years’ imprisonment or a A$1.5 million fine. Unlicensed sales of any tobacco products could face fines up to A$660,000, and health inspectors will be granted greater powers to issue on-the-spot closure orders for non-compliant premises. Premier Minns stated that the federal government’s heavy taxes on legal tobacco are contributing to the black market, and current penalties are insufficient deterrents.

Australia has some of the highest cigarette prices in the world, with taxes accounting for approximately three-quarters of the cost. According to Dr. Fei Gao, a business law lecturer at the University of Sydney Business School, about A$1.40 of the cost of each cigarette is tobacco excise, in addition to the Goods and Services Tax (GST). This excise tax is indexed twice yearly and is also subject to an additional 5% annual increase for three years, which began in September 2023.

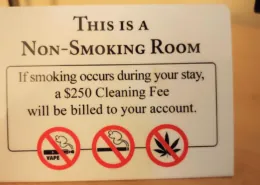

This policy is based on the principle that higher costs deter smoking. Indeed, daily smoking rates among Australians aged 14 and over have fallen from nearly 20% in 2001 to about 8% today. However, this decline has been partially offset by the rapid rise of vaping, with about 7% of Australians now vaping. Furthermore, the high price of legal cigarettes has pushed many consumers towards the black market. The value of illicit tobacco flowing into Australia has surged from an estimated A$980 million in 2016-17 to over A$6 billion in 2022-23.

This has led to a sharp decline in projected government revenue from tobacco excise, from a peak of A$16.3 billion in 2019-20 to an estimated A$7.4 billion in the last fiscal year, while enforcement costs are rising. The federal government has allocated an additional A$156 million over the next two years to combat the illicit trade.

Dr. Gao suggests that while comparing the situation to the U.S. Prohibition era might be an overstatement, there are “regrettable similarities,” where policy has unintentionally fueled a black market and organized crime. She believes better control could be achieved through increased funding to fight illicit tobacco and setting “reasonable” tax rates. However, for the government, lowering excise duty would completely contradict its public health objectives. The challenge remains to find a balance that discourages smoking without empowering a dangerous and violent criminal underworld.

- Read more: Australia: NSW Cracks Down on Illegal Vapes with Jail Time & Evictions

- News source: 澳洲烟草税或重演“禁酒令”后果 非法烟草如何有效管控?

- Alabama Lawmaker Proposes Ban on Vaping in Public Places - August 7, 2025

- Australia’s High Tobacco Tax Fuels Black Market, NSW Cracks Down - August 7, 2025

- Malaysia Considers Tobacco Tax Hike After 10-Year Freeze - August 7, 2025