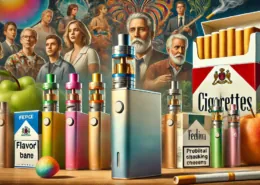

Hawaii Lawmakers Propose 70% Tax Rate For Vaping Products

Lawmakers in Hawaii have proposed a 70% tax on e-cigarettes and e-liquid products, in a bid to tackle youth addiction to the devices. Currently, e-cigarettes in Hawaii carry a general excise tax ranging from 4.1% to 4.7%, but combustible cigarettes attract additional taxes. Rep. Scot Matayoshi, a leading sponsor of the bill, said he hoped the tax would reduce the negative health effects of nicotine addiction. However, opponents argue that raising prices could encourage smokers to stick to combustible products. A representative of e-cigarette seller VOLCANO called the 70% tax an “industry killer”.

Tax on Vaping Devices and E-liquid Products Proposed to Fight Nicotine Addiction in Hawaii

The use of electronic smoking devices, or e-cigarettes, has become a growing concern in Hawaii, particularly among the youth. Rep. Scot Matayoshi has been fighting this issue for four years, and this year, he and other lawmakers have proposed a new approach to tackle this problem. They want to impose a 70% tax on electronic smoking devices and e-liquid products.

Current Taxation on E-cigarettes in Hawaii

At present, e-cigarettes in Hawaii only carry the general excise tax ranging from 4.1% to 4.7%. However, combustible cigarettes are subjected to other taxes. Rep. Matayoshi believes that the proposed 70% tax under House Bill 537 will bring vaping into tax parity with cigarettes and other nicotine products that already carry additional taxes.

Read more: Vaping Tax in the U.S. State by State

Negative Health Effects of Vaping

Rep. Matayoshi’s main aim is to reduce the negative health effects associated with nicotine addiction in the community by making vaping more expensive. He stated that nicotine is as addictive as heroin and has many negative health effects that society will have to deal with down the line.

Will Increased Prices Deter Vaping?

Dylan Higa, a 30-year-old vaper, stated that he would still buy vaping products even if the prices increase because he is already addicted. Higa has been vaping for five years and spends around $80 to $100 on e-cigarettes per month. He believes that people will continue to vape, even if the prices increase, just as they continue to smoke cigarettes despite their high cost.

Opposition to the Proposed Tax

Steven Greenhut, the Western region director of the research organization R-Street Institute that does work in tobacco reduction, opposed the legislation during a recent hearing in the House. He fears that raising taxes on vaping will discourage people who smoke from switching to a less dangerous product. He cited a government study from England that found vaping is 95% less harmful than smoking combustible cigarettes. He believes that over-taxing will not reduce nicotine addiction.

Impact on Vaping Industry

Scott Rasak, a representative of VOLCANO eCigs, described the 70% tax as an industry killer. He believes that some of the bills proposed are ending people’s businesses and livelihoods that they spent the last decade building. He wishes that the Legislature would work more with the vaping industry to understand how it can make a positive impact on the community, instead of targeting retailers who are selling the products under legal provisions.

Conclusion

The proposed tax on vaping devices and e-liquid products is an attempt to reduce nicotine addiction and its negative health effects among the community. While some believe that increased prices may not deter everyone, others fear that over-taxing will discourage people who smoke from switching to a less dangerous product. It is essential to strike a balance between public health concerns and the impact on the vaping industry.

- Cambodia: Phnom Penh Bans Smoking & Vaping on “Walk Street” - August 16, 2025

- Mexico City Congress Approves Ban on Vapes & E-Cigs - August 16, 2025

- Is It Illegal to Vape or Smoke While Driving in Minnesota? - August 15, 2025