Illinois Triples Vape Tax to 45% Starting July 1st

Illinois is set to implement significant tax increases on vaping products and most other tobacco items (excluding traditional cigarettes) starting July 1st. The state tax on vaping products will triple, rising from 15% to 45% of the wholesale price. Similarly, most other tobacco products, including cigars and chewing tobacco, will see their wholesale tax increase from 36% to 45%. Non-tobacco nicotine products like Zyn nicotine pouches and nicotine-containing lozenges and gum are also subject to this higher 45% tax.

These “sin tax” hikes, part of the new fiscal year budget, are projected to raise approximately $50 million for the state. Of this, $5 million is earmarked for tobacco cessation programs, with the remaining $45 million intended to help fund Medicaid. Retailers and distributors have expressed concern, with Taha Saleem of American Distributors noting that the 45% tax will squeeze retailer profits, potentially leading them to absorb some costs or pass significant price increases onto consumers. He estimated a can of Zyn pouches might rise from $4.50 to $6.50.

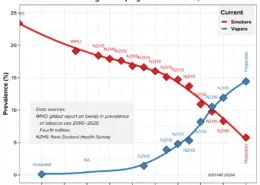

While lawmakers and health advocacy organizations like the American Lung Association supported the increases, citing public health benefits and the need to deter youth use (nearly 17% of Illinois high school students reported e-cigarette use in 2021), some experts and industry representatives voiced concerns. David Merriman, a public policy professor, warned that taxing vaping products too heavily might discourage smokers from switching to a potentially less harmful alternative. Nate Harris of the Illinois Fuel & Retail Association also raised concerns about consumers potentially taking their business to border states with lower taxes. The state tax on a standard pack of 20 cigarettes remains unchanged at $2.98.

- Malaysia Negeri Sembilan Backs Vape Ban, Awaits Clear Laws - August 5, 2025

- Is It Illegal to Vape or Smoke While Driving in Massachusetts? - August 5, 2025

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025