Michigan Governor Proposes Vape Tax and Flavor Ban Effective April 1, 2025

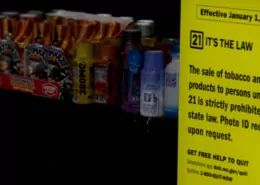

Governor Gretchen Whitmer’s latest proposal to tax e-cigarettes in Michigan could result in a sweeping ban on most vaping products, as the plan would prohibit the sale of any items not authorized by the FDA. The proposed tax, which aims to curb usage and protect public health, would extend the state’s 32% wholesale tax on tobacco products to e-cigarettes and other nicotine delivery devices starting April 1, 2025.

Under the governor’s proposal, flavored vapes that have not received FDA approval would be subject to seizure and forfeiture as contraband products. Businesses caught selling these products would face civil and criminal sanctions, including fines for any hazardous waste disposal costs incurred by the state. As of January 2025, the FDA has only authorized 34 tobacco- and menthol-flavored e-cigarette products from three companies: NJOY, LLC, RJ Reynolds Vapor Company, and Logic Technology Development, LLC.

The proposed ban on non-FDA-approved vaping products has drawn criticism from industry representatives and some lawmakers. Jim McCarthy, spokesperson for the American Vapor Manufacturers Association, warned that the ban “would destroy hard-working small businesses across the whole state of Michigan.” House Speaker Matt Hall, R-Richland Township, said the provision would likely kill the larger tax plan in the Republican-led House, as many adults prefer flavored vapes.

Governor Whitmer’s office declined to comment specifically on the potential ban on flavored vape products, which the governor previously attempted to enact in 2019 through an emergency health order that was later blocked by the courts. Instead, spokesperson Stacey LaRouche referred to the governor’s comments during last month’s State of the State address, where she emphasized the need to act smart on vapes to protect children’s health and futures.

Health advocates have generally praised Whitmer’s tax proposal but have expressed concerns about the state’s ability to enforce a ban on non-FDA-approved products. Dr. Brittany Tayler, co-chair of the Keep MI Kids Tobacco Free Alliance, suggested that the state should focus first on establishing a tobacco retail register, as Michigan is one of only ten states that do not require any form of retail license to sell tobacco.

The impact of the proposed ban on vape shops and consumers remains uncertain. Daniel Carr, manager of the Wild Side Smoke Shop in East Lansing, said the store would likely survive due to its diverse product offerings but predicted higher prices for consumers. Carr, a 25-year-old who has vaped since he was 18, said he might stop vaping if prices increased or flavors were pulled from the market.

As the debate over Governor Whitmer’s vape tax and flavor ban proposal continues, lawmakers and stakeholders will need to weigh the potential public health benefits against the economic impact on businesses and the preferences of adult consumers. The fate of the proposed legislation will likely be determined in the coming months as the April 1, 2025 effective date approaches.