New Mexico Bill Proposes Higher Tax Rate on Vaping Products and Nicotine Pouches

The New Mexico Senate Tax, Business and Transportation Committee has advanced a bill (Senate Bill 20) that aims to increase the tax rate on e-cigarettes, nicotine pouches, and other synthetic nicotine products. The bill, sponsored by Sen. Martin Hickey, D-Albuquerque, passed the committee with a 4-3 vote on Feb 18.

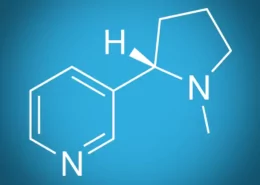

Sen. Hickey, a retired physician, emphasized that the bill’s main objective is not to generate revenue but to discourage young people in New Mexico from using vaping devices and nicotine pouches. He stated, “The reason for this bill is it is a youth health bill. It’s the kids I’m trying to save from learning addictive behaviors that, if they do (learn them), will plague them with other substances potentially for the rest of their lives.”

Tax Rate and Revenue

If approved, the bill would impose a 40% excise tax on the wholesale price of tobacco products, excluding cigarettes and cigars. Sen. Hickey estimates that the bill would generate between $5 million and $10 million annually. The legislation would also create a new fund, administered by the state Department of Health, to help pay for nicotine prevention efforts.

Changes to the Bill

The original version of the bill included a provision to increase the state’s cigarette tax rate from $2 to $3 per pack. However, this provision was removed due to pressure from lobbyists representing large tobacco companies. The current version of the bill focuses on broadening the definition of nicotine and raising the tax rate for e-cigarettes and other products.

- Bestselling Vapes in UK After Disposable Ban: What to Stock 2025 - August 8, 2025

- Argentina Debates Stricter Vape Laws Amid Prohibition Failures - August 8, 2025

- Nigeria Advocacy Group Urged to Hike Tobacco & Vape Tax by 100% - August 8, 2025