Nigeria Advocacy Group Urged to Hike Tobacco & Vape Tax by 100%

The Corporate Accountability and Public Participation Africa (CAPPA) has called on the Nigerian Federal Government to immediately increase the excise tax on all tobacco and nicotine products, including vapes and e-cigarettes, to 100 percent. The advocacy group argues this move is a proven way to discourage use, save thousands of lives, and reduce the significant economic burden of tobacco-related diseases.

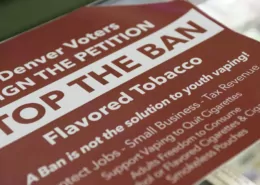

In a statement, CAPPA warned that the tobacco industry is aggressively targeting young Nigerians with novel products like vapes, which they know are addictive and harmful, under the guise of a “tobacco harm reduction strategy.” Akinbode Oluwafemi, Executive Director at CAPPA, stated, “What the tobacco industry is doing is grooming the next set of addicts to replace the thousands of Nigerians who die from tobacco-related diseases… They must be stopped.”

Citing an analysis by the Centre for the Study of the Economies of Africa (CSEA), CAPPA noted that Nigeria spent ₦526.4 billion treating tobacco-related diseases in 2019 alone. With Nigerians consuming over 20 billion cigarettes annually and nearly 30,000 people dying each year from related illnesses, the group insists that a substantial tax hike is necessary. Nigeria’s current mixed excise system includes a 30% ad valorem tax and a specific excise of ₦84 per pack, a structure CAPPA deems insufficient.

The organization urged Nigeria to emulate other African nations like Senegal, which recently increased its tobacco tax to 100%, and Kenya, which banned the import of tobacco and nicotine products. CAPPA also recommended that part of the revenue from the proposed tax increase be ring-fenced for health promotion, non-communicable disease prevention, and the full implementation of the National Tobacco Control Act, while advising the government to resist industry interference.

- Bestselling Vapes in UK After Disposable Ban: What to Stock 2025 - August 8, 2025

- Argentina Debates Stricter Vape Laws Amid Prohibition Failures - August 8, 2025

- Nigeria Advocacy Group Urged to Hike Tobacco & Vape Tax by 100% - August 8, 2025