Saskatchewan, Canada to Tax Vaping Products from June 1, 2025

The Government of Saskatchewan, Canada, introduced amendments to The Provincial Sales Tax Act, 2025 on March 24, aiming to remove the provincial sales tax (PST) exemption on vapour products. As of June 1, 2025, a six percent PST will be applied to all vapour products in the province, in addition to the existing vapour products tax, according to a provincial government news release.

The decision to impose PST on vapour products was initially announced as part of the 2025-26 Budget and is expected to increase PST revenues by $3 million annually. However, the government emphasizes that the benefits extend beyond mere tax revenue.

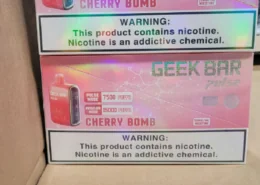

The government release highlights the detrimental effects of nicotine exposure on the healthy brain development of youth and young adults, which can lead to issues with learning, memory, and mood, as well as an increased risk of addiction to other substances.

Erin Kaun, President and CEO of Lung Saskatchewan, commended the Saskatchewan Government’s decision, stating, “Increased taxation is one of the most effective strategies in reducing consumption, particularly among youth. We look forward to continuing to work with the government to support a healthier Saskatchewan.”

The move to tax vaping products in Saskatchewan is part of a growing trend among governments worldwide to regulate and discourage the use of these products, particularly among younger generations.

- News source: Tax on vaping products to begin June 1

- Malaysia Negeri Sembilan Backs Vape Ban, Awaits Clear Laws - August 5, 2025

- Is It Illegal to Vape or Smoke While Driving in Massachusetts? - August 5, 2025

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025