U.S. Vape Market: Distributors, Trends, and Growth

The vape industry in the United States has been on a rollercoaster ride in recent years, with rapid growth, regulatory challenges, and shifting consumer preferences all playing a part in shaping the market. As someone who has been closely following the industry’s developments, we have witnessed firsthand how the U.S. has become a top destination for e-cigarette companies looking to expand their global presence.

U.S. Vape Market Set for Explosive Growth

Let’s start with some jaw-dropping statistics. In 2023, China’s e-cigarette exports to the U.S. reached a staggering $3.1 billion, according to data from the General Administration of Customs of the People’s Republic of China. This massive market has attracted numerous vape companies eager to get a slice of the pie, making the U.S. a prime choice for overseas expansion.

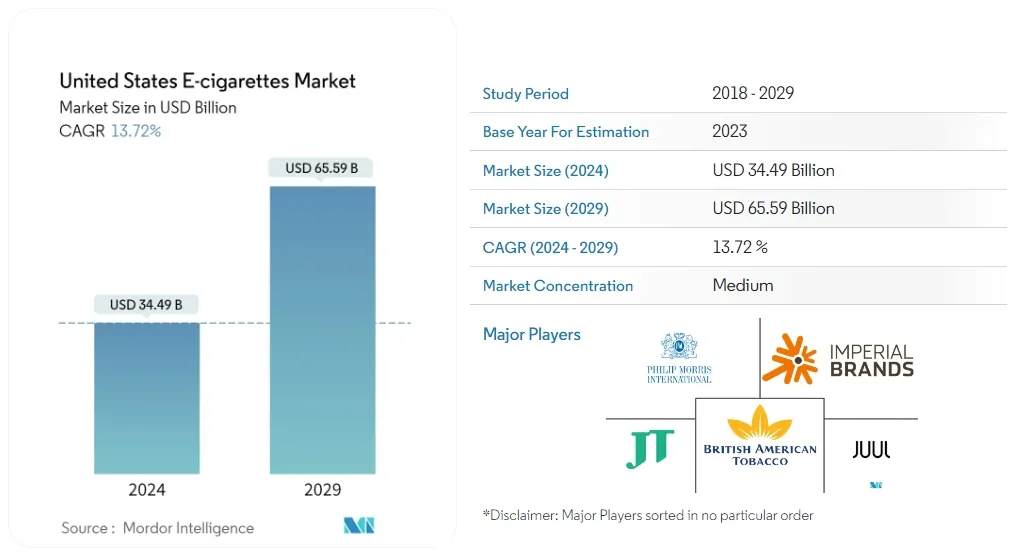

But that’s just the tip of the iceberg. The U.S. vape market is expected to experience explosive growth in the coming years. Brace yourself for these numbers: the market size is projected to reach USD 34.49 billion in 2024 and grow at a mind-boggling CAGR of 13.72% to hit USD 65.59 billion by 2029. That’s a lot of zeros!

So, what’s driving this incredible growth? A couple of key factors come into play. Firstly, e-cigarettes have become increasingly popular among the youth population. Secondly, vape shops have been popping up across the country faster than you can say “e-liquid.”

Top Vape Distributors in the U.S.

Now that we’ve established just how huge the U.S. vape market is, let’s take a closer look at the key players. Ecigator, a vape manufacturer that knows a thing or two about the industry, has put together a list of the top vape distributors in the U.S. based on user feedback and industry information as of January 22.

From Illinois to California, Florida to Texas, these distributors are spread across the country, each offering a unique blend of products and services. Some specialize in disposables, others in open systems, and a few even venture into the world of CBD. Here’s a quick snapshot of the top 15:

| No. | Company Name | Region | Main Business |

|---|---|---|---|

| 1 | MIDWEST | Illinois, USA | Disposable |

| 2 | UNISHOW | USA | Disposable, CBD, E-liquid |

| 3 | HAPPY DISTRO | California, USA | Disposable, Open System |

| 4 | Generalvape | Florida, USA | Disposable |

| 5 | DEMANDVAPE | USA | Disposable |

| 6 | SAFA GOODS | Florida, USA | Disposable, Open System |

| 7 | KMG Imports | California, USA | Disposable |

| 8 | American Vapor | USA | Disposable |

| 9 | Vapor Beast | Florida, USA | Open System, E-liquid |

| 10 | Mig Vapor | California, USA | Open System, CBD |

| 11 | World Wide Vape | Texas, USA | Disposable |

| 12 | AK wholesale | Illinois, USA | Disposable, Open System |

| 13 | Muhammad Khan | USA | E-liquid |

| 14 | LAO VAPOR | Texas, USA | Disposable, Open System |

| 15 | Empire Imports | California, USA | Disposable |

Trends Driving the U.S. Vape Market

As with any thriving industry, the U.S. vape market is not immune to change. Two major trends have emerged in recent years, each playing a significant role in shaping the market’s future.

Health Concerns Fuel Market Growth

Firstly, rising health concerns among smokers have fueled the market’s growth. With the increasing prevalence of tobacco-related cancers and other smoking-associated health issues, more and more Americans are turning to e-cigarettes as a potentially safer alternative or a tool for quitting smoking altogether.

Offline Retail Sales Dominate

Secondly, offline retail sales, particularly through vape shops, have become the dominant distribution channel for e-cigarettes in the U.S. Consumers appreciate the wide range of products available in these shops and the opportunity to learn about product features from knowledgeable staff. Many vape shops even offer personalized e-liquid mixtures, adding an extra layer of convenience for customers.

Industry Overview and Competitive Landscape

The U.S. vape market is not for the faint of heart. It’s a highly competitive landscape, with numerous large enterprises battling it out for market share. Giants like Philip Morris International Inc., Imperial Brands PLC, Japan Tobacco Inc., British American Tobacco PLC, and Juul Labs Inc. are constantly adapting their strategies to stay ahead of the game, focusing on product innovation and mergers and acquisitions to cater to evolving customer preferences.

Recent developments in the industry have been nothing short of fascinating. In November 2022, R.J. Reynolds Tobacco Company’s composite tobacco material patent hinted at a potential “smokeless” form of tobacco consumption. That same month, Philip Morris claimed to have acquired 93% of Swedish Match’s shares as part of a plan to introduce reduced-harm cigarettes in the U.S. market. And in June 2022, Japan Tobacco Inc. published a patent application for a “device” involving a smoking system with a flavor inhaler, allowing users to enjoy flavors and essences without the need for combustion.

Market Segmentation

To truly understand the U.S. vape market, it’s essential to examine its various segments. The market can be divided based on product type, battery mode, and distribution channel, each offering unique insights into consumer preferences and market dynamics.

| Segment | Details |

|---|---|

| Product Type | Completely Disposable Model, Rechargeable but Disposable Cartomizer, Personalized Vaporizer |

| Battery Mode | Automatic E-cigarettes, Manual E-cigarettes |

| Distribution Channel | Offline Retail, Online Retail |

Frequently Asked Questions

As someone who has been immersed in the U.S. vape market for years, I’ve encountered my fair share of questions from curious consumers and businesses alike. Here are some of the most common queries I’ve come across:

How big is the United States E-cigarettes Market?

The United States vape market size is expected to reach USD 34.49 billion in 2024 and grow at a CAGR of 13.72% to reach USD 65.59 billion by 2029.

Who are the key players in the United States Vape Market?

Philip Morris International Inc., Imperial Brands PLC, Japan Tobacco Inc., British American Tobacco PLC, and Juul Labs Inc. are the major companies operating in the United States vape market.

What is the future outlook for the U.S. Vape Market?

The future outlook for the U.S. vape market includes potential health concerns and the impact of alternative nicotine delivery systems.

What role can technology play in the future of the U.S. Vape Market?

Technology can play a significant role in the future of the U.S. vape market, including age-verification technology, smart devices for data collection, and potential integration with smoking cessation apps.

Conclusion

The U.S. vape market is a fascinating, ever-evolving landscape that presents both challenges and opportunities for consumers and businesses alike. As health concerns continue to drive more smokers to seek out alternatives and the popularity of e-cigarettes among youth shows no signs of slowing down, the market is poised for remarkable growth in the years to come.

By staying informed about the key players, trends, and developments shaping the industry, consumers can make more informed decisions about their vaping habits, while businesses can better position themselves to capitalize on the market’s immense potential.

As someone who has been watching this industry closely, I can’t help but feel excited about what the future holds. With new technologies and innovations emerging all the time, the possibilities for the U.S. vape market are truly endless. So, whether you’re a curious consumer or a business looking to make your mark, buckle up and get ready for an exhilarating ride!

Source: United States E-cigarettes Market Size & Share Analysis – Growth Trends & Forecasts (2024 – 2029)

- Russia’s Vape Market: Inside the Battle for Control - August 8, 2025

- Brazil: Paraná Bill to Add Vaping to “No Smoking” Signs - August 8, 2025

- Celebrate with EightVape: 10 Lucky Winners Get Free Orders or $100 Gift Cards - August 8, 2025