EU Nicotine Pouch Market Regulation Trends: Online vs Traditional

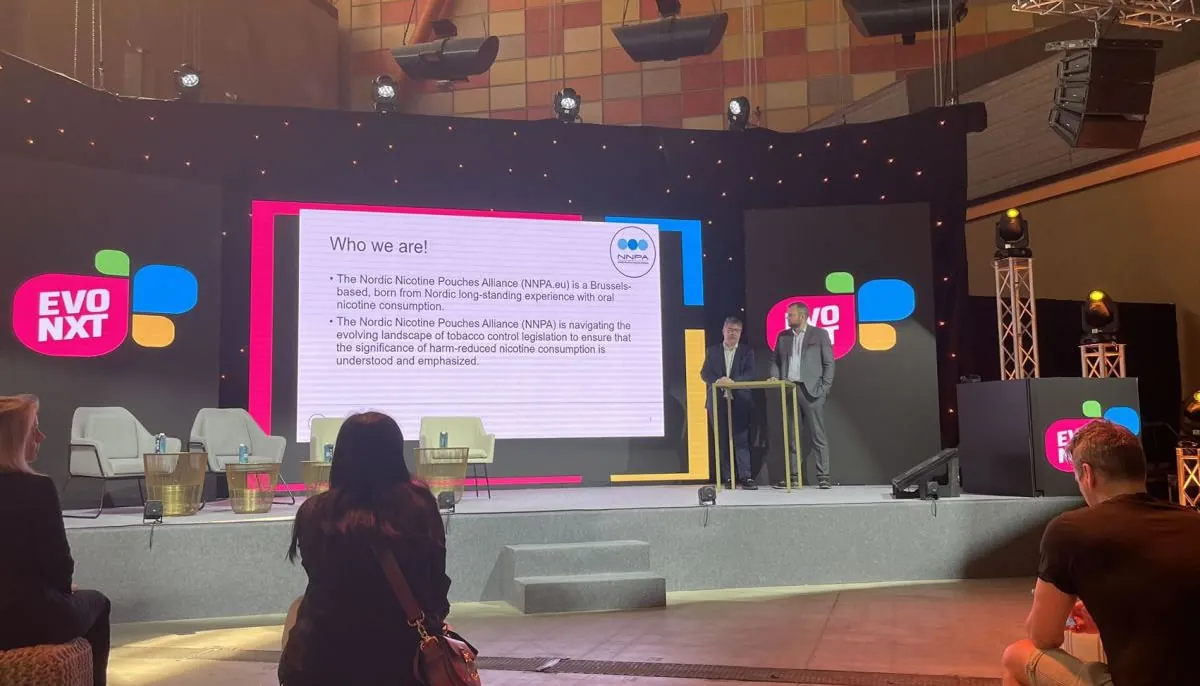

On April 5, the EVO NXT tobacco exhibition in Spain hosted a forum focused on analyzing the EU market for nicotine pouches. The keynote speakers, Jonas Lundqvist, CEO of the Nordic Nicotine Pouch Association (NNPA.EU), and Robert Casinge, Editor-in-Chief of pouchforum.eu, shared their insights on the current trends and future prospects of nicotine pouch regulation in the EU.

Regulation vs Prohibition

Casinge highlighted that while EU countries have varying stances on nicotine pouches, the overall trend leans towards regulation rather than outright bans. To date, 11 EU member states have announced bills to regulate nicotine pouches, with only France, Luxembourg, and the Netherlands opting for bans. The upcoming update to the EU Tobacco Products Directive (TPD3), expected to come into effect in 2027, may include nicotine pouches, allowing member states some flexibility in transposing the directive into national law.

Market Trends and Leading Brands

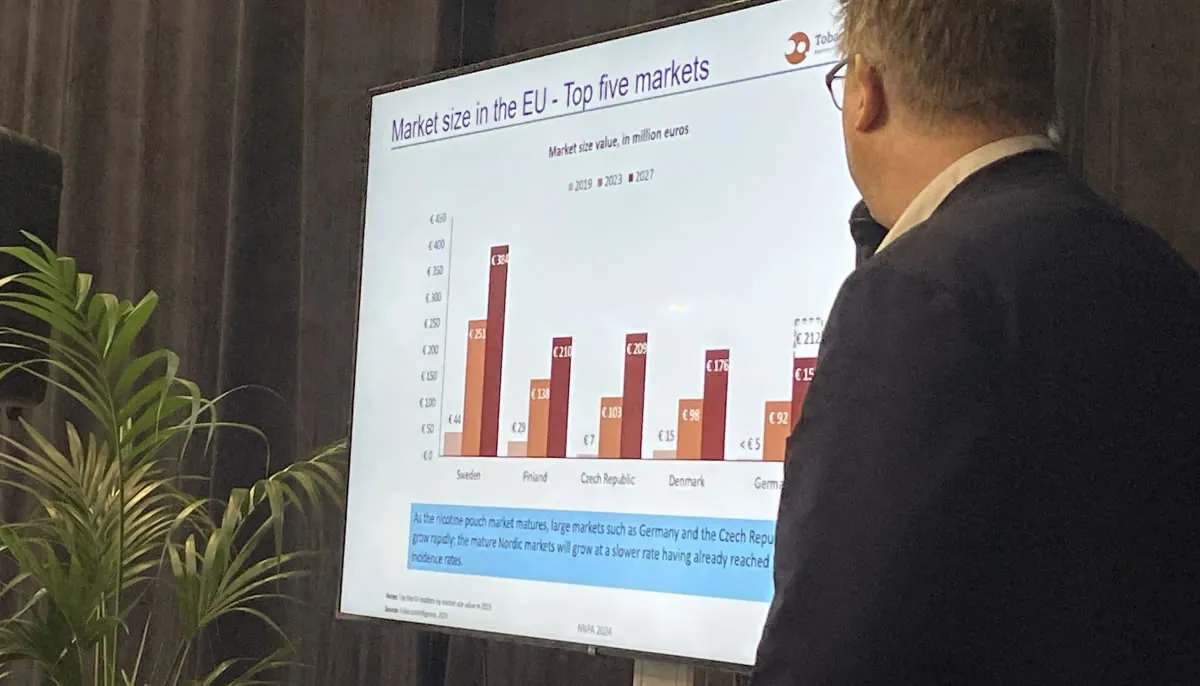

The EU nicotine pouch market is vast, with Sweden, Finland, the Czech Republic, Denmark, and Germany leading the top five markets. Popular brands vary across markets, with Velo and Zyn being favorites in Sweden, Skruf and Killa in Finland, Velo and Dope in the Czech Republic, Velo, Killa, and Ace in Denmark, and Nos, Thor, and Loop in Spain. Austria favors Velo, Skruf, and Lyft.

As the market matures, large markets like Germany and the Czech Republic are experiencing rapid growth, while mature Nordic markets are expected to grow at a steadier pace. Trends in nicotine pouch products include new forms of intake like gum and film, as well as innovative packaging and taste experiences.

Sales Channels and Market Share

The ratio of online to traditional sales channels for nicotine pouches in the EU is approximately 1:2. Outside the Nordic countries, countries with large populations and high smoking rates, such as Poland, France, and Spain, are witnessing the fastest growth in nicotine pouch users.

In 2023, the online sales share of the EU nicotine pouch market slightly declined, mainly due to Finland’s online sales ban. However, the online market share is expected to increase again by 2027, with new markets becoming active and brands expanding within the EU.

Conclusion

Casinge concluded that although nicotine pouches offer an important alternative to traditional tobacco, with better economic benefits and lower prices (except in the Czech Republic), they face strong regulatory policy threats. While supporters are mostly among the public and experts, EU governments remain negative in their policy and regulatory formulation, calling for bans or strict controls.

- Is It Illegal to Vape or Smoke While Driving in Minnesota? - August 15, 2025

- American Airlines Vaping Passenger Alleges Assault in Police Report - August 15, 2025

- NEXA PIX 35K Disposable Vape with Crystal Tank Review - August 15, 2025