How to Get a Vape Business License in Canada (2025 Guide)

The Canadian vaping market presents a significant opportunity for entrepreneurs, but successfully launching a business requires navigating a complex and multi-layered regulatory landscape. Obtaining the correct licenses is not just a formality; it’s a critical legal requirement that governs every aspect of the industry, from manufacturing and importing to retail sales. This comprehensive guide provides a step-by-step roadmap for securing your vape business licenses in Canada, covering federal, provincial, and municipal requirements to ensure your venture is built on a compliant and successful foundation.

Understanding Canada’s Multi-Layered Vaping Regulations

Before diving into applications, it’s essential to understand that Canada regulates vaping products at three distinct levels: federal, provincial/territorial, and municipal. Your business will need to comply with the rules at each level to operate legally.

- Federal Government: Health Canada and the Canada Revenue Agency (CRA) oversee national laws like the Tobacco and Vaping Products Act (TVPA) and the Excise Act, 2001. These acts govern manufacturing standards, product safety, packaging, advertising, and federal excise duties.

- Provincial/Territorial Governments: Each province and territory has its own legislation that often adds further restrictions on top of federal law. This is where you’ll find variations in the legal vaping age, rules for public consumption, specific retail licensing requirements, and provincial sales taxes.

- Municipal Governments: Cities and towns can impose their own bylaws, which typically cover zoning (where a vape shop can be located), local business license fees, and health and safety inspections.

Successfully navigating this system requires a clear understanding of your specific business activities (e.g., manufacturing, importing, or retail only) and the specific requirements of your chosen location.

Step 1: Federal Licensing for Manufacturers and Importers

If your business plan involves manufacturing vaping products in Canada (which includes blending e-liquids or packaging devices) or importing packaged vaping products, your first step is to secure a federal license from the Canada Revenue Agency (CRA).

The Federal Vaping Product Licence

Under the Excise Act, 2001, you must obtain a Vaping Product Licence to legally manufacture or import these goods. This is a critical requirement for anyone involved in the production supply chain.

- Who Needs It: Businesses that manufacture, produce, blend, mix, or package vaping products in Canada, or those that import packaged vaping products for the purpose of applying the required excise stamps.

- Application Process: You must complete and submit Form L600, Vaping Product Licence Application, to your regional CRA excise office. The application requires a detailed business plan, operational specifics, and financial information.

- Financial Security: Applicants must provide financial security (e.g., a bond) to the CRA. The amount required is a minimum of $5,000 and a maximum of $5 million, calculated based on your projected business activities.

- Validity: The license is valid for up to three years and must be renewed at least 30 days before expiration. There are no application fees for the federal license itself.

Excise Duty and Stamping Regime

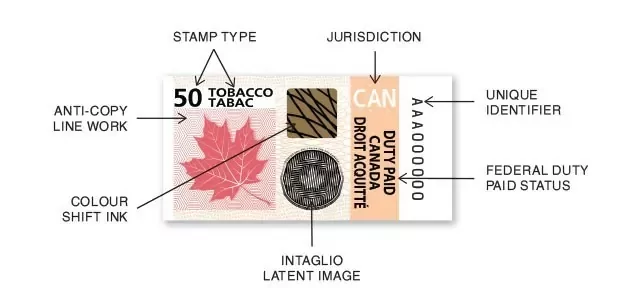

A key responsibility for federal licensees is managing the vaping excise duty. All vaping products entering the Canadian duty-paid market must be packaged and affixed with the appropriate vaping excise stamp before they can be sold to retailers. This stamp proves that federal duties have been paid.

- Registration: Manufacturers and importers must register for the vaping stamping regime separately to be able to purchase and apply these stamps.

- Jurisdiction-Specific Stamps: As of January 1, 2025, there are different stamps for different jurisdictions. A peach-colored “Canada” stamp is used for non-specified provinces, while provinces that have entered into a coordinated taxation agreement (like Ontario, Quebec, and others) require a specific color-coded stamp indicating that both federal and provincial duties have been paid.

Manufacturer’s Insight: For retailers, understanding this stamping regime is crucial. When sourcing inventory, ensure your supplier is a federally licensed manufacturer or importer and that all products you receive bear the correct excise stamp for your province. Selling unstamped products is illegal and can lead to severe penalties.

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

18K Disposable Pod Kit

Disposable Pod Kit – 18ml changeable pod with 650mAh rechargeable battery.

20K with Large Screen

20000 Puffs Disposable Vape with large screen. Normal and Boost working modes.

30K DTL Disposable

30K Puffs DTL(Directly to Lung) disposable vape with airflow control and screen.

Step 2: Provincial and Municipal Licensing for Retailers

Once you’ve addressed federal requirements (if applicable), the next step is to secure the necessary licenses to operate your retail store. This is where regulations vary most significantly.

Provincial Retail Permits and Registrations

Most provinces and territories require a specific license or permit for businesses to sell tobacco and/or vaping products. The name of the license, the issuing body, the fees, and the specific rules can differ greatly.

- Ontario: Businesses that primarily sell vape products (at least 85% of sales) must register as a Specialty Vape Store with their local public health unit. This registration allows for certain in-store displays and promotions not permitted in general retail stores like convenience stores. In addition, municipalities have their own licensing.

- Nova Scotia: Retailers need a Vaping Products Retail Vendor’s Permit, which costs $124.60 per location and is valid for three years.

- British Columbia: While there isn’t a specific “license,” retailers must provide a Notice of Intent to Sell E-Substances to the Ministry of Health and comply with strict rules under the Tobacco and Vapour Products Control Act, which distinguishes between age-restricted and all-ages premises.

- Saskatchewan: Retailers need a Vapour Products Tax (VPT) License to collect and remit the 20% provincial tax on these products.

- New Brunswick: An Electronic Cigarette Sales Outlet License is required, with an annual fee of $100.

Municipal Business Licenses

In addition to provincial permits, you will almost certainly need a general business license from your city or town. Many larger municipalities have also created a specific license category for vape retailers with its own fees and conditions.

- Toronto: Requires a Vapour Product Retailer Licence, with an initial total fee of $743.14 and an annual renewal of $362.82. The application process includes screening criteria related to criminal convictions.

- Ottawa: Requires a business license for vapor product retailers, with annual fees ranging from $990 to $1,152.

- Calgary: Requires a Tobacco & Vaping Retailer License, with fees from $146 to $714 annually.

These municipal licenses often come with zoning approvals, ensuring your chosen location complies with local bylaws (e.g., minimum distance from schools), and may require health and fire inspections before being issued.

ECIGATOR

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

Step 3: Key Regulatory Compliance Areas for All Vape Businesses

Beyond obtaining licenses, continuous adherence to various regulatory aspects is non-negotiable for any vape business in Canada. Failure to comply can result in severe penalties, including substantial fines, seizure of products, legal action, or the suspension or revocation of your licenses.

| Compliance Area | Description | Key Requirements |

|---|---|---|

| Product Labelling & Packaging | Ensuring all vaping products meet federal and provincial standards for packaging and labeling. | Child-resistant packaging; mandatory health warnings; clear indication of nicotine concentration; comprehensive ingredient lists. |

| Age Verification | Strictly preventing the sale of vaping products to individuals below the legal age (typically 19, varies by province). | Mandatory checking of valid government-issued photo ID for all customers appearing under 25; prominent display of age restriction signage at point of sale. |

| Advertising & Promotion | Adhering to federal and provincial restrictions on how vaping products can be advertised and promoted. | Prohibition on marketing that targets youth; restrictions on lifestyle advertising, endorsements, and certain health claims. Display restrictions in many retail environments. |

| Excise Duty & Stamping | Collecting and remitting federal excise duties on vaping products and ensuring proper stamping. | Accurate record-keeping of sales and inventory; timely payment of duties to the CRA; application of correct federal and jurisdiction-specific excise stamps. |

| Reporting Obligations | Submitting required sales data, ingredient lists, and other operational information to Health Canada and/or provincial authorities. | Regular, accurate reporting as per the Vaping Products Reporting Regulations; maintaining detailed sales and inventory records for audit purposes. |

| Health & Safety Standards | Ensuring the business premises meet all local health, fire, and safety regulations. | Passing regular inspections; adherence to local fire codes, public health guidelines, and proper ventilation standards. |

This table summarizes the critical compliance areas for vape businesses in Canada, highlighting the diverse regulations that apply to product characteristics, sales practices, and operational standards.

The Application Process: A Step-by-Step Overview

While the specifics will vary by location, the general process for getting licensed follows a clear path:

- Finalize Your Business Plan: Have your detailed business and financial plans ready.

- Establish Your Business Entity: Register your business as a sole proprietorship or corporation and obtain your federal business number and tax accounts from the CRA.

- Secure Federal Licenses (If Applicable): If you are manufacturing or importing, apply to the CRA for your Vaping Product Licence and register for the stamping regime. This can take 30-60 days.

- Secure Your Location and Zoning Approval: Once you have a potential retail location, confirm with your municipality that it meets all zoning requirements for a vape shop. Do this before signing a lease.

- Apply for Provincial Permits: Submit your application for the required provincial retail permit or registration (e.g., Specialty Vape Store in Ontario, Vendor’s Permit in Nova Scotia). This can take 1-4 weeks.

- Apply for Municipal Licenses: With your provincial permits in hand (if required), apply for your local municipal business license. This may involve health and fire inspections. This can take 2-8 weeks.

- Set Up Supplier Accounts: Once licensed, you can set up accounts with federally licensed manufacturers and distributors to procure your inventory.

It is wise to plan for a minimum of 6 to 12 months from the start of the process to the day you open your doors.

Conclusion:

Opening a vape shop in Canada requires navigating a demanding but well-defined regulatory path. Success hinges on a thorough understanding of the multi-layered licensing system, from the federal requirements for manufacturers and importers down to the specific business permits issued by your local city hall. By conducting meticulous research, developing a comprehensive business plan, and maintaining an unwavering commitment to compliance with all age verification, product, and marketing regulations, entrepreneurs can build a successful and responsible business. The Canadian vaping market, while challenging, offers significant opportunities for those who are prepared to operate professionally within its established legal framework.

- Malaysia Negeri Sembilan Backs Vape Ban, Awaits Clear Laws - August 5, 2025

- Is It Illegal to Vape or Smoke While Driving in Massachusetts? - August 5, 2025

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025