New Excise Tax Trends in the Vape Industry

Insights into New Excise Tax Trends: Unlocking Opportunities for the E-Cigarette Market Worldwide

Understanding the Expansion of Excise Taxes in the European E-Cigarette Industry

The landscape of excise taxes in the e-cigarette industry is rapidly evolving, particularly within the European Union (EU). To date, 15 EU member states have already implemented excise taxes on e-liquids, and this number is expected to grow as more countries follow suit. The European Commission is also in the process of developing a new Tobacco Excise Directive (TED) aimed at harmonizing these taxes across all EU member states. This directive could have significant implications for the industry, as it seeks to unify tax policies and prevent tax evasion across the region.

What is Excise Duty?

Excise duty is a form of indirect tax imposed on specific goods, such as tobacco, alcohol, and energy products. Unlike other taxes, excise duty is not universally applied but rather targets particular product categories. In the context of the e-cigarette industry, excise duty can significantly impact manufacturers, suppliers, and ultimately, consumers.

In the EU, when a product is subject to excise duty, it is considered a “harmonized product,” meaning it falls under the EU’s common excise duty system. This system regulates all aspects of the product’s lifecycle, including manufacturing, trading, distribution, and storage.

Harmonized Products in the E-Cigarette Industry

With the potential implementation of the TED, e-cigarette products are likely to become harmonized under EU law. This would mean that all economic activities related to these products, from manufacturing to distribution, would be subject to the same set of regulations across the EU.

How is Product Harmonization Decided?

The decision to harmonize a product is made collectively by the EU member states. Once a product is harmonized, it is subject to the EU’s common excise duty system and a uniform set of European regulations. This harmonization process is crucial for ensuring consistency in how excise taxes are applied across different countries.

What Does Product Harmonization Involve?

Harmonization covers all aspects of economic activity related to a product, including its manufacturing, trading, distribution, and storage. For the e-cigarette industry, this could mean that all these activities would need to comply with standardized EU regulations, potentially simplifying operations for businesses operating across multiple countries.

Excise Tax Products in the European Vape Industry

Every product subject to excise tax, including raw materials like nicotine base used in manufacturing e-liquids, must be produced in a tax warehouse. The transportation of these products must occur between tax warehouses with appropriate security measures in place.

Raw Materials Subject to Excise Tax:

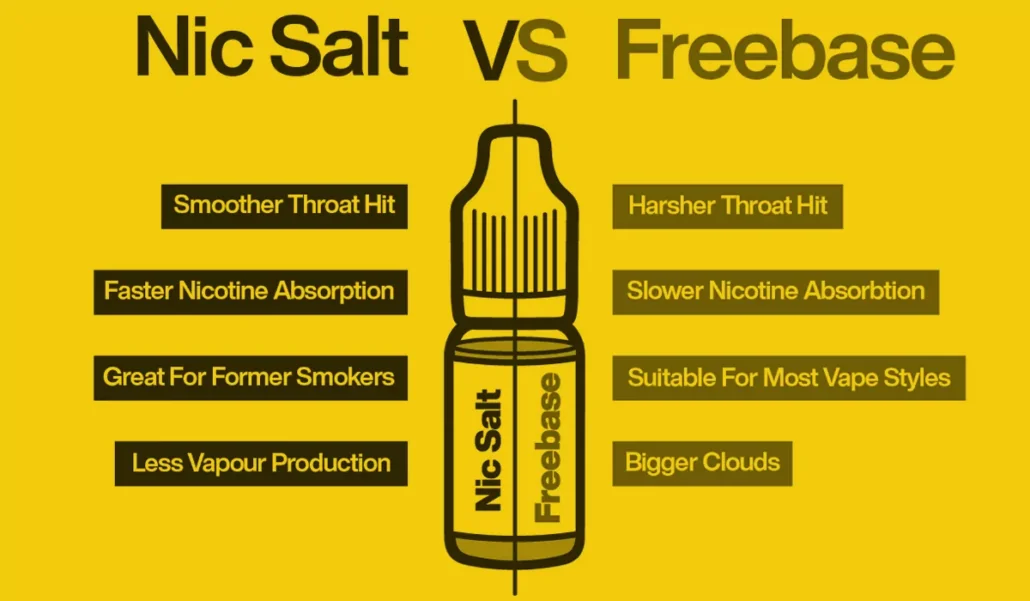

- Nicotine base

- Nicotine salt base

- Hybrid base (nicotine + nicotine salt)

- PG/VG base

Also Read:

Nicotine Base vs Nicotine Base

Retail E-Liquids Subject to Excise Tax:

- Nicotine e-liquids

- Nicotine salt e-liquids

- Hybrid e-liquids

- Nicotine-free pre-mixed e-liquids

The Dynamic European E-Liquid Market

The European e-liquid market is currently experiencing rapid changes, with new updates and announcements regarding excise tax adjustments being released almost every month. These changes are reflective of the broader trend towards increasing regulation of the e-cigarette industry across the continent.

Tobacco Excise Directive (TED) – What You Need to Know

The Tobacco Excise Directive (TED) is a forthcoming regulation that will impose excise taxes on tobacco products, including those within the e-cigarette industry. The TED aims to standardize excise taxes across the EU, helping to prevent tax evasion and ensuring that all member states apply consistent tax rates to these products.

The proposal for the TED is expected to be introduced in 2023, and once it takes effect, it will bring about significant changes to the way excise taxes are applied to e-cigarette products across the EU.

Excise Taxes Beyond the Tobacco Excise Directive

Even as the TED is being developed, many countries have already begun implementing or increasing excise taxes on e-cigarette products. It is important to note that excise taxes are national taxes, meaning that each country has the authority to set its own tax rates and policies.

For example, Bulgaria introduced an excise tax on e-liquids starting March 1, 2023, with a rate of 0.18 Bulgarian Lev per milliliter. This rate is set to increase on January 1, 2024, and again on January 1, 2025.

In addition to excise taxes, other regulatory measures are also being introduced in various countries. In January 2023, Belgian authorities announced a ban on e-cigarette devices containing additional elements such as LED lights, and mandated that flavor names on labels must be limited to one word.

The Future of the Tobacco Excise Directive

Excise tax is an indirect tax, and its harmonization at the EU level means that every member state must levy excise taxes on specific product groups. However, the exact amount of excise tax can vary from one country to another.

Once the TED takes effect, it is likely that changes in transportation regulations will occur. Products will be moved between tax warehouses within the EMCS computer system under the excise duty suspension procedure (without excise duty being paid). This applies to domestic trade, trade between EU member states, and trade within the European Community as part of both export and import activities.

Specific rates for these products will also be established, which will benefit many businesses by providing a more predictable and standardized tax environment. While the complete elimination of excise taxes in all countries is unlikely, the introduction of a unified excise tax within the EU could simplify operations for companies and their customers operating in countries where excise tax is in effect.

How to Operate Safely in the Vape Industry

To legally produce e-liquids or nicotine base products, a tax warehouse must be established, or excise tax must be prepaid.

Prepayment of Excise Duty

Prepaid excise tax is an option when a manufacturer does not have a tax warehouse. This process involves several formal activities and the creation of records, as taxes must be paid before production can legally begin.

For many companies, prepaid excise tax is an unfeasible solution because it requires large sums of money to be paid upfront, disrupting the company’s financial liquidity.

Tax Warehouse

A tax warehouse is an area approved by the national administration where people can legally produce excise-taxed goods, store them, and transfer them between tax warehouses—complying with legal requirements and meeting all quality and technical standards set by national authorities.

If a manufacturer owns a tax warehouse, they can produce excise-taxed goods themselves without the need to prepay taxes. However, the total value of products produced and stored in a day cannot exceed the financial guarantee amount of the tax warehouse.

Transportation of Excise Goods

What is the difference in transporting excise-taxed products to countries where excise tax applies versus those where it does not? The mode of transportation remains the same, although there are some nuances.

Sales of Excise Goods:

- Sales to countries where excise tax applies: After shipping, the customer signs the receipt document, thereby relieving the manufacturer of their financial guarantee under the suspension of excise tax in their country. From this point, the customer is responsible for the excise tax on the purchased goods according to their country’s requirements.

- Sales to countries where excise tax does not apply: After delivery, the customer signs the receipt document, releasing the manufacturer from their financial guarantee. Since the customer’s country does not have excise tax, they bear no legal or financial obligation for the received goods.

ECIGATOR

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

Securing the International Supply Chain

If your supply chain is international and involves purchasing goods from a country where excise tax applies, it is crucial to ensure that every excise-taxed product is manufactured in a tax warehouse, and its transportation occurs between tax warehouses with sufficient financial security.

If your supplier does not have a tax warehouse, this could indicate illegal operations, which may lead to legal consequences for your business. Additionally, the safety and continuity of your orders could be at risk, as shipments may be halted.

Even if your country does not have excise taxes, you may still be required to testify as a witness in criminal and financial proceedings.

Excise Tax Policies in Key Markets

1. United Kingdom

New Tax Policy: The UK is planning to introduce a new tax on e-cigarettes, featuring a three-tier structure: £1 per 10ml for nicotine-free e-liquids, £2 per 10ml for low-concentration nicotine e-liquids (0.1-10.9mg/ml nicotine), and £3 per 10ml for high-concentration nicotine e-liquids (≥11mg/ml nicotine). Additionally, e-cigarette products will also be subject to a 20% value-added tax (VAT).

Impact: This new tax policy is expected to significantly increase the retail price of e-cigarettes, impacting users across the country. The government aims to use tax measures to encourage smokers to switch to e-cigarettes while deterring non-smokers, particularly children, from starting to vape.

Ban on Disposable E-Cigarettes: The UK government also plans to ban disposable e-cigarettes starting in April 2025 to further regulate the e-cigarette market.

2. Germany

E-Cigarette Tax: Germany was one of the first countries to tax e-cigarettes. A specific tax is levied on each 10ml bottle of e-liquid, with plans to increase the tax in the future.

3. Sweden

Tobacco and Alcohol Tax Proposal: Sweden has proposed an increase in tobacco and alcohol taxes, suggesting that the tax on e-liquids and other nicotine-containing products be increased by approximately 1% starting January 1, 2024.

4. Netherlands

Ban on Flavored E-Cigarettes: The Netherlands has banned the production of flavored e-cigarettes and set a deadline for their sale.

5. Slovenia

Tobacco Products Excise Tax Proposal: Slovenia imposes excise taxes on nicotine-containing e-liquids, with rates adjusted over time.

Also Read:

Slovenia Proposes Ban on Vape Flavors

6. United States

Taxation Status: The taxation of e-cigarettes varies across US states and local governments. As of August 2024, several states have implemented excise or wholesale taxes on e-cigarettes. These taxes are typically based on the retail price, wholesale price, or specific units (e.g., per milliliter of e-liquid).

Specific Cases:

- California: California levies excise and retail taxes on e-cigarette products. The excise tax rate is determined based on the nicotine content and wholesale cost of e-cigarette products, with a 12.5% retail tax imposed on all nicotine-containing e-cigarette products.

- Colorado: Colorado’s excise tax rate on e-cigarettes has gradually increased from 30% in 2020 to 56% in 2024, with plans for further increases in the coming years. The state also imposes a specific tax per milliliter of e-liquid.

- Minnesota: Minnesota was the first US state to tax e-cigarettes, initially setting the rate at 70% of wholesale cost, which has since increased to the current rate of 95%.

- Other States: States such as New Jersey and New Mexico also levy different forms of taxes on e-cigarettes, including taxes per unit, per milliliter, or as a percentage of the retail price.

- Is Vaping or Smoking While Driving Illegal in Hawaii? - July 29, 2025

- Australian Gov’t Rejects Research on Smoking Rise After Vape Ban - July 29, 2025

- Vape-Linked Stock CEA Industries Surges 650% on $500M BNB Treasury Deal - July 29, 2025