Vape Excise Tax in Canada and How to Calculate

The taxation of vaping products in Canada varies depending on the province or territory. Some provinces, such as British Columbia and Alberta, do not have a specific tax on vaping products, while others, such as Quebec and Nova Scotia, have implemented a tax on e-cigarettes and e-liquids. The federal government has also implemented an excise tax on vaping products.

In an effort to regulate the vaping industry, the Canadian government has announced the implementation of a new excise duty on vaping products as part of Budget 2022. This tax will come into effect on October 1, 2022, and will apply to both domestically manufactured and imported vaping substances intended for use in vaping devices within Canada.

What Does This Mean, and How Will it Impact You?

Vape excise tax is a tax on vaping products that is implemented by the government to raise revenue and discourage the use of vaping products. The excise tax is a specific tax on a product or service, and it is typically included in the price of the product.

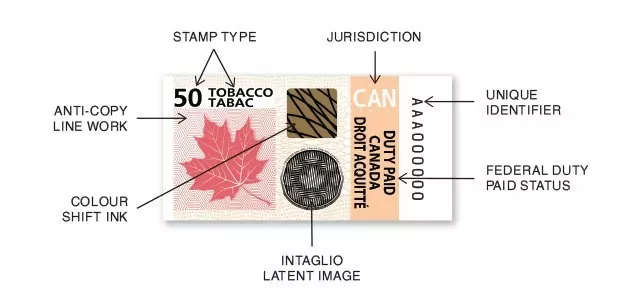

The government’s introduction of the excise duty mandates that all e-liquids or pre-filled pods/cartridges sold in Canada must bear an excise tax stamp, similar to those found on tobacco and cannabis products.

How to Calculate the Excise Duty?

The rates for the excise duty on vaping products can be found in Schedule 8 of the Excise Act, 2001, and are as follows:

For vaping liquids:

- $1 per 2ml on the first 10mL of e-liquid (or pod, or disposable) (effectively, $5 on the first 10mL of a bottle)

- $1 per 10 mL for quantities exceeding the first 10 mL

Updated:

The Ontario and Quebec government is introducing a new Provincial Vaping Excise Tax starting July 1, 2024. This move aims to deter vaping by increasing the cost of vape products, thereby contributing to public health efforts by discouraging nicotine consumption, particularly among the youth.

| Tiers | Federal Tax(Current) | Federal Tax 12% Tax Increase (July 1st, 2024) | Provincial Tax(ON, QC, NU, NWT)Including 12% Tax Increase | TOTAL Fed. + Prov. Tax(July 1st, 2024) |

|---|---|---|---|---|

| 0.1mL to 2mL | $1 | $1.12 | $1.12 | $2.24 |

| 2.1mL to 4mL | $2 | $2.24 | $2.24 | $4.48 |

| 4.1mL to 6mL | $3 | $3.36 | $3.36 | $6.72 |

| 6.1mL to 8mL | $4 | $4.48 | $4.48 | $8.96 |

| 8.1mL to 10mL | $5 | $5.60 | $5.60 | $11.20 |

| 10.1mL to 20mL | $6 | $6.72 | $6.72 | $13.44 |

| 20.1mL to 30mL | $7 | $7.84 | $7.84 | $15.68 |

| 30.1mL to 40mL | $8 | $8.96 | $8.96 | $17.92 |

| 40.1mL to 50mL | $9 | $10.08 | $10.08 | $20.16 |

| 50.1mL to 60mL | $10 | $11.20 | $11.20 | $22.40 |

Which Products Will be Affected?

The excise duty will only apply to e-liquids and products containing e-liquids, such as disposable vapes, e-cigars, and pre-filled pod and cartridge systems.

However, it will not impact vape hardware, including non-filled, refillable devices sold without e-liquid.

Is Vaping Still a More Cost-Effective Option?

Absolutely! Despite the introduction of the excise tax, vaping remains a more affordable choice compared to smoking.

For instance, a smoker who consumes one pack a day would spend approximately $119.00 on cigarettes per week, whereas the same individual would only spend $41.86 on pre-filled Ecigator Vape Products or $22.95 on a 30ml bottle of e-liquid within the same timeframe.

Ways to Reduce the Cost of Vaping

There are several ways to reduce the cost of vaping, including:

Buying in Bulk

Buying vaping products in bulk can be a cost-effective way to reduce the cost per unit. Many online retailers offer discounts on bulk purchases, which can help you save money.

DIY E-Liquid

Making your own e-liquid can be a cost-effective way to reduce the cost of vaping. There are many recipes available online, and the ingredients can be purchased in bulk.

Shopping Around

Shopping around for the best prices can help you save money on vaping products. Compare prices between different retailers, both online and in-store, and look for deals and promotions that can help you save money.

Using Refillable Pods or Tanks

Using refillable pods or tanks can be a cost-effective way to reduce the cost of vaping. Instead of purchasing pre-filled pods or tanks, which can be more expensive, refillable pods or tanks can be refilled with e-liquid, which can be purchased in bulk.

Avoiding High Nicotine Products

High nicotine products can be more expensive than low nicotine products. By choosing lower nicotine products, you can reduce the cost of vaping without sacrificing the vaping experience.

The taxation of vaping products in Canada varies depending on the province or territory. Some provinces, such as British Columbia and Alberta, do not have a specific tax on vaping products, while others, such as Quebec and Nova Scotia, have implemented a tax on e-cigarettes and e-liquids.

Question Answered

Why does the government of Canada tax vaping products?

The government of Canada taxes vaping products to raise revenue and discourage the use of vaping products.

How is vape tax calculated in Canada?

The calculation of vape tax in Canada varies depending on the province or territory. It can be an excise tax, which is a percentage of the manufacturer’s price, or a sales tax, which is a percentage of the total price paid by the consumer.

Can I reduce the cost of vaping in Canada?

Yes, there are several ways to reduce the cost of vaping in Canada, including buying in bulk, making your own e-liquid, shopping around for the best prices, using refillable pods or tanks, and avoiding high nicotine products.

Are there any provinces in Canada that do not tax vaping products?

Yes, some provinces in Canada, such as British Columbia and Alberta, do not have a specific tax on vaping products.

Is vaping cheaper than smoking traditional tobacco products?

Vaping can be cheaper than smoking traditional tobacco products, but the cost depends on the type of vaping product and how often it is used.

- Bestselling Vapes in UK After Disposable Ban: What to Stock 2025 - August 8, 2025

- Argentina Debates Stricter Vape Laws Amid Prohibition Failures - August 8, 2025

- Nigeria Advocacy Group Urged to Hike Tobacco & Vape Tax by 100% - August 8, 2025