Delaware Lawmakers Propose Tobacco and Vape Tax Hikes

Delaware lawmakers are advancing legislation to substantially increase taxes on cigarettes, other tobacco products, and vaping items. This push for higher “sin taxes” comes after a proposal by Governor Matt Meyer’s administration to introduce new personal income tax brackets for higher earners was shelved, with House Speaker Melissa Minor-Brown deeming the initial income tax relief for lower earners insufficient.

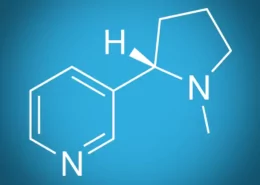

The new tobacco tax bill, House Bill 215, proposes a $1.50 per pack increase on cigarettes, which would raise the state tax from $2.10 to $3.60 per pack. This is three times the 50-cent increase initially recommended by Governor Meyer. The bill also seeks to raise the tax on other tobacco products from 30% to 45% of the wholesale price. For vaping products, the proposed legislation would increase the tax from 5 cents to 25 cents per milliliter of e-liquid and also hike several licensing fees for sellers.

Speaker Minor-Brown argues that increasing tobacco taxes is a proven method to reduce tobacco use, especially among youth. “When you increase tobacco tax, less people smoke. That is a fact,” she stated, adding that even tobacco companies acknowledge this effect. According to the American Lung Association (AMA), high school tobacco use in Delaware is at 18.3%, higher than the adult rate of 16.20%. While Delaware has received good grades from the AMA for tobacco prevention funding and smoke-free air, its tobacco tax structure has been rated an “F” for over a decade.

Proponents believe HB 215 will update Delaware’s tax structure to reflect the growing market share of products like nicotine pouches and vapes, while also generating much-needed state revenue. Addressing concerns that tobacco taxes are regressive, Speaker Minor-Brown countered that the state already bears over $500 million in tobacco-related healthcare costs, and discouraging use benefits everyone. The bill has a tight three-week window to pass through the legislature and, if signed into law, would take effect in September.

- Is It Illegal to Vape or Smoke While Driving in the UK? - August 11, 2025

- Virginia Roanoke Considers $20,000 Annual Fee for Vape Shops - August 11, 2025

- Mississippi to Ban Unauthorized Vape Products in October - August 11, 2025