Illegal Flavored Disposable Vape Sales in the U.S. Reach $2.4 Billion in 2024

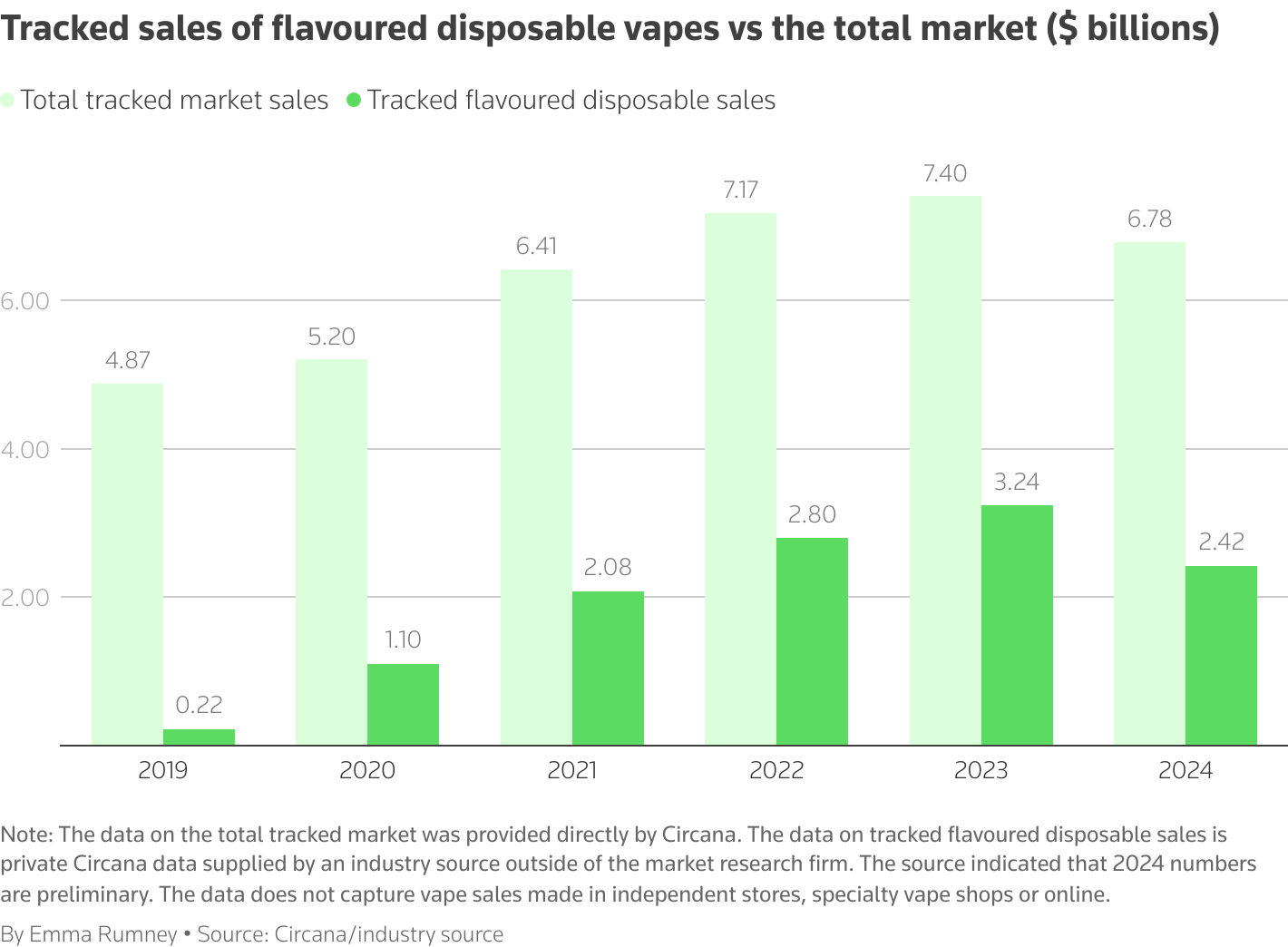

Sales of unauthorized, flavored disposable vapes in the United States amounted to approximately $2.4 billion in 2024, representing 35% of the e-cigarette market in outlets such as convenience stores and supermarkets, according to private retail sales data reviewed by Reuters. The data, provided by an industry source outside of the market research firm Circana, shows a decline from $3.2 billion in 2023 and $2.8 billion in 2022.

The U.S. Food and Drug Administration (FDA) has only authorized 34 tobacco- or menthol-flavored vape products for legal sale in the United States, all of which are produced by big tobacco companies such as British American Tobacco and Altria. However, the private Circana data tracked around 11,000 unauthorized flavored disposable e-cigarette products on the market from hundreds of brands, featuring flavors such as “cookie and cloud” and “magic cotton candy.”

The data provides a rare glimpse into the scale of illegal vape sales across the U.S., where the market has been inundated with unauthorized products. Circana estimates that the entire vape market it tracks, which includes authorized products as well as non-disposable vapes, was worth $6.8 billion last year. This suggests that flavored disposable vapes account for approximately 35% of the market tracked by Circana, although the company’s data only captures sales in certain channels and does not include online sales, independent stores, and specialty vape outlets.

The figures showed a 25% contraction in flavored disposable vape sales since 2023, but the industry source noted that Circana’s 2024 numbers were preliminary and its data on disposable vapes had been revised upwards in the past. Despite this, major tobacco companies BAT and Altria, whose U.S. tobacco and vape businesses have lost market share to unauthorized products, maintain that the market is growing. Altria CEO Billy Gifford stated at a conference on February 19 that the U.S. vape market expanded by 30% in 2024, “driven entirely by illicit products.”

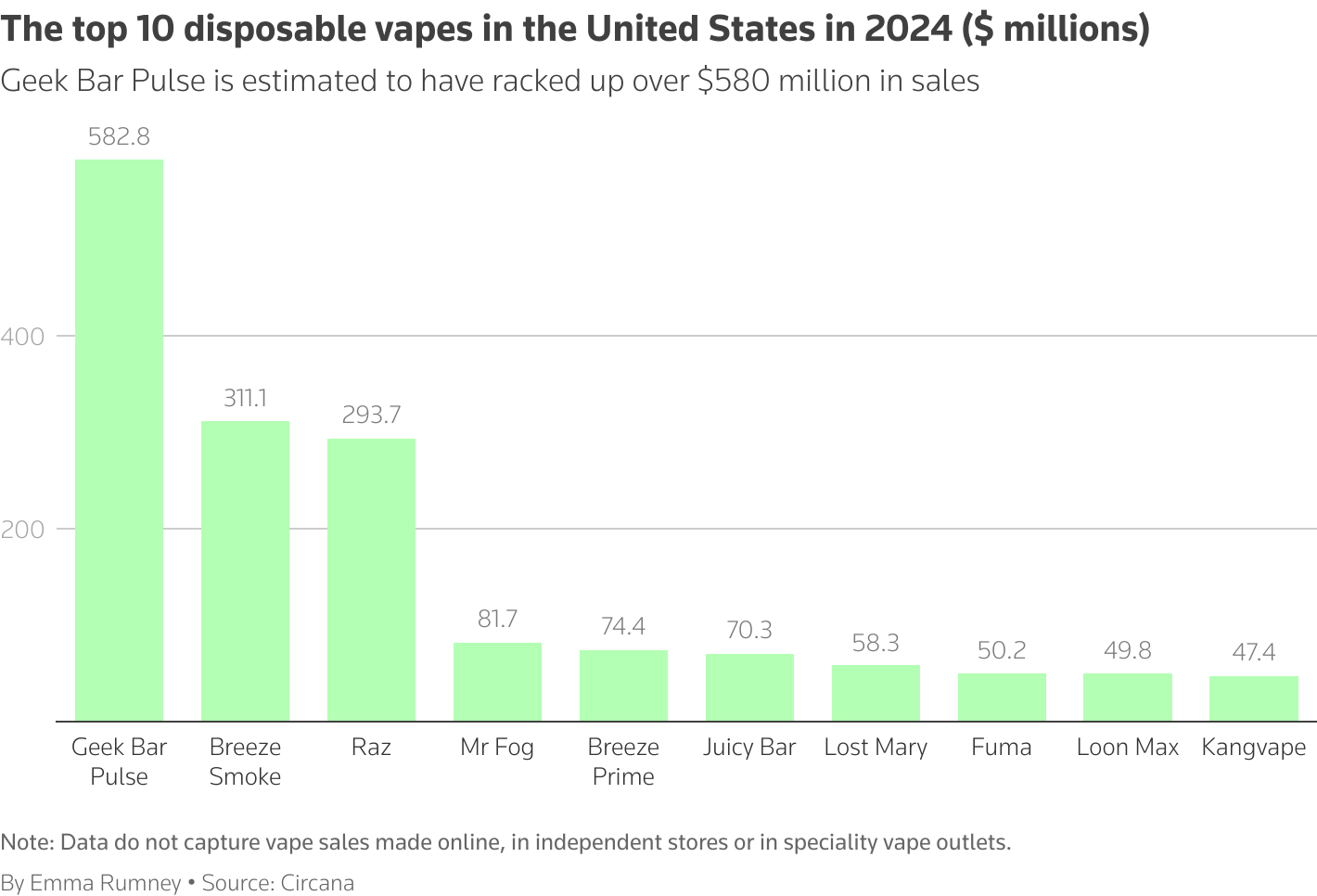

The data revealed that FDA efforts to crack down on unauthorized vape sales have had some impact. Previously top-selling labels Esco Bars and Elf Bars both dropped out of the top 10 most sold devices in 2024 after the FDA blocked their imports in 2023. However, other brands have quickly taken their place, highlighting the ongoing challenge of regulating the rapidly evolving vape market.

As the debate surrounding the regulation of flavored disposable vapes continues, the private retail sales data underscores the significant presence of unauthorized products in the U.S. market. While the FDA’s efforts have shown some success in curbing the sale of specific brands, the overall market for illegal flavored disposable vapes remains substantial, posing ongoing challenges for public health officials and policymakers.

- Bestselling Vapes in UK After Disposable Ban: What to Stock 2025 - August 8, 2025

- Argentina Debates Stricter Vape Laws Amid Prohibition Failures - August 8, 2025

- Nigeria Advocacy Group Urged to Hike Tobacco & Vape Tax by 100% - August 8, 2025