U.S. Vape Regulations: PMTA Registration and State Compliance

As the year 2024 unfolds, the United States is witnessing a significant shift in the regulatory landscape surrounding vape products. Various states have taken the initiative to introduce unique “Registry Bills” (also known as PMTA Registry Bills) to further regulate the retail sales of e-cigarettes and nicotine products. These bills, once passed by state legislatures, are expected to be implemented with substantial support from the tobacco industry, with the primary goal of creating or modifying product registration lists.

Understanding the Regulatory Background

Before diving into the intricacies of state-specific regulations, it’s essential to understand the role of the U.S. Food and Drug Administration (FDA) in the vape market. Manufacturers are required to submit a Pre-Market Tobacco Application (PMTA) to the FDA before selling their vape products (ENDS). Once the FDA approves the application, the product can be sold indefinitely. However, if the application is rejected, the product must be removed from the market. The lengthy FDA review process has led some manufacturers to risk selling their products without final approval, potentially facing unauthorized sales and penalties.

Also Read:

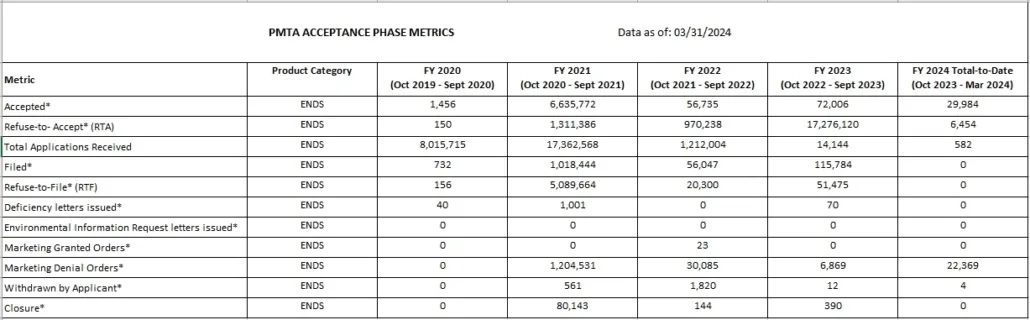

Premarket Tobacco Product Applications

Current FDA Approval Status

As of now, the FDA has only approved 39 tobacco-flavored e-cigarette products((updated July/2025)). The agency has not strictly enforced actions against manufacturers that have not submitted PMTAs or continue to sell unapproved products. As a result, the market remains flooded with numerous e-cigarette products lacking proper FDA authorization, and this number continues to grow.

How State Registry Bills Operate

While the specific wording of state registry bills may vary, they generally aim to establish a public registry of e-cigarette products managed by state governments. Manufacturers are required to provide proof of a Market Order (MGO) issued by the FDA, evidence of pending PMTA review by the FDA, or, in some states, proof of an FDA-issued Market Denial Order (MDO) that has been stayed.

Certain bills allow manufacturers to self-certify that their products meet relevant standards, which might facilitate the entry of unauthorized products into the market to some extent. However, these laws may have marginal benefits in excluding disposable e-cigarettes produced by Chinese manufacturers that have not undergone the PMTA process.

Read the full list of PMTA ACCEPTANCE PHASE METRICS

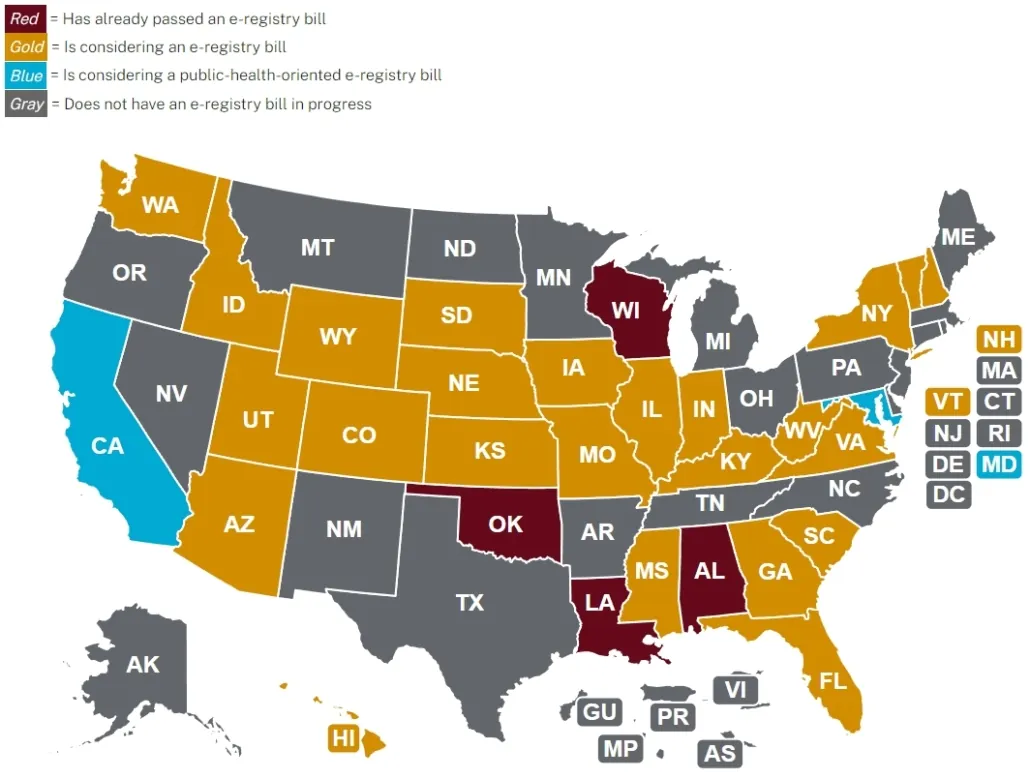

Read more: More States Consider Establishing Vapor Product Directories

Implementation Status of State Registry Bills

In 2024, several U.S. states have introduced e-cigarette registry bills, including:

- Florida (SB1006) and (HB1007), Hawaii (SB 3385 and HB 2794), Indiana (SB227), Missouri (HB2211), New Hampshire, Utah (SB 133), Vermont (H.729), Virginia (SB550), Washington (SB6118), and Wisconsin.

- Alabama, Louisiana, Utah, and Oklahoma have successfully passed registry bills.

- In Georgia, Mississippi, South Carolina, Tennessee, and West Virginia, registry bills have been submitted but have not yet become law.

- The laws in Kentucky, Utah, and Wisconsin are set to take effect in 2025.

Accessing Product Lists in States with Implemented Registry Systems

Currently, four states have successfully implemented registry systems, and the public can access online queries for registered products, although the registered manufacturers and products vary due to different regulations.

- Louisiana: Vape Directory Information

- Alabama: My Alabama Taxes

- Oklahoma: Oklahoma ABLE Commission

- Wisconsin: Wisconsin Department of Revenue

In Oklahoma, over 10,000 products have been registered, including 19 Chinese vape manufacturers submitting a total of 3,306 products. Notably, Runfree Weixing Technology submitted 2,690 products (each flavor registered individually), along with companies like IJOY and PNDUS. In Wisconsin, a list of tobacco and e-cigarette products is published by enterprise, with a total of 478 companies. In Louisiana, 497 SKUs have been registered, but no Chinese brands or manufacturers have submitted registrations. Similarly, in Alabama, 17 companies have submitted 969 product SKUs, with no domestic brands identified.

Also Read:

Oklahoma Vape Registry

Wisconsin Tobacco Vapor Products Permits list

Louisiana vape directory

Alabama Electronic Nicotine Delivery System (ENDS) Manufacturers Directory

(1. Go to the Businesses section

2. Click View or upload a report

3. Select ENDS Products Directory under Tobacco Reports

4. Search by Manufacturer or Product)

The Impact of Gradual Bill Implementation

As state legislation is expected to take effect around January 2025, the market still has significant time and space to adapt. However, once these bills are passed or officially enforced, the U.S. industry market may exhibit the following trends and phenomena:

1. Limited Market Choices, Increased Transparency

To meet state registration requirements, manufacturers must submit detailed product and company information, enhancing brand transparency. Consumers and regulatory agencies will be able to access manufacturer and product information more easily, increasing market visibility. However, the high cost and complexity of the PMTA process may lead manufacturers to apply for only a portion of their products, reducing market variety, especially for disposable products unlikely to receive PMTA approval. Additionally, some states prohibit the sale of various flavored e-cigarettes, further limiting consumer choice.

2. Regional Market Differentiation, Increased Focus on Local Marketing

Different state implementation standards and regulatory focuses will exacerbate regional market rule differences. Cross-state trade may be restricted, and manufacturers will need to comply with specific state requirements, increasing operational complexity and costs. Therefore, localized sales strategies will focus more on in-state sales and distribution. Localized and regional market strategies will become key for manufacturers to adapt to different state regulations.

3. Increased Compliance Costs, Strengthened Brand Position

To meet PMTA requirements, manufacturers will need to invest additional resources, potentially raising product costs. Increased costs may be passed on to consumers, resulting in generally higher product pricing. Some manufacturers may abandon multi-brand or sub-brand strategies, concentrating resources on core products. Streamlining brand portfolios helps reduce operational costs and ensure that key products meet regulatory requirements, maintaining market competitiveness. As regulation strengthens, compliant products and well-known brands will occupy a more advantageous position in the market due to meeting strict PMTA requirements. Consumers may be more inclined to choose these reputable products.

4. Market Confidence Fluctuations, Increased Risk of Black Market Transactions

If states strengthen enforcement, some distributors may rush to clear out unregistered product inventory through discount promotions to attract consumers, potentially causing short-term price fluctuations and reduced profits for manufacturers. Additionally, tightening regulations may prompt some consumers and distributors to turn to black market transactions to evade regulation and taxes. The proliferation of the black market could encroach on legitimate manufacturers’ market share and damage the industry’s reputation due to inconsistent product quality. Therefore, manufacturers need to enhance anti-counterfeiting measures to address this challenge.

Future Outlook of the U.S. Industry Market

As regulatory policies gradually take effect and market adjustments deepen, the U.S. vape industry will move toward a more standardized and mature market environment. Although the market will face some challenges and uncertainties in the short term, in the long run, compliance, transparency, and quality will become the key themes for industry development. Non-compliant and weaker manufacturers will be gradually eliminated in competition with U.S. domestic brands and large tobacco company vape brands, with market share gradually converging on those compliant and strong manufacturers. For manufacturers aspiring to establish a foothold in the U.S. market, understanding state regulations, actively adjusting market strategies, and enhancing product quality will be crucial to standing out in the competition.

Faced with the complex and ever-changing regulatory requirements of various U.S. states, e-cigarette manufacturers need to adapt flexibly, cleverly adjust sales strategies, strengthen local market penetration, actively explore new cooperation paths, and build strong strategic alliances with retailers and distributors to collectively navigate market fluctuations. Meanwhile, strengthening brand promotion and market outreach, improving consumer awareness and loyalty, will also be critical tasks. In this stringent regulatory environment, e-cigarette brands must also be innovative, striving to create differentiated products. Through developing cutting-edge technologies, optimizing user experiences, and shaping personalized brand images, they can stand out in the fiercely competitive market and win consumers’ favor.

As legislation gradually takes effect, the U.S., currently the world’s largest vape market, will undergo a series of profound changes and severe challenges. This transformation will not only reshape the market landscape but also profoundly impact the fate of all participants. Only those who closely follow market demand, adhere to compliance, focus on brand building, and innovate in product technology can stand firm in this fierce market competition and secure a foothold.

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025

- Vaping vs. THC Drinks: Which Cannabis Option Is Right for You? - August 4, 2025

- Colombia’s New Vape Law: A Reality Check on Enforcement - August 4, 2025