Virginia New Vape Laws and Tax Likely Headed to Governor

As Virginia’s 2024 legislative session draws to a close, two bills and a new tax on vape products are expected to land on the governor’s desk. The proposed measures aim to address the growing concern over youth vaping, but not everyone is pleased with the potential changes.

Vape Shop Owner’s Perspective

Michael Midgette, owner of several vape and glass shops, including Capitol Smoke in Richmond, expressed his dissatisfaction with the bipartisan efforts in Virginia’s House and Senate that would limit his ability to sell vape tobacco products.

“And you’re consuming nicotine. It’s not healthy. You know that [and] you’re going to do it anyway,” Midgette said.

State Registry and FDA-Approved Products

One of the bills with a potentially significant impact would establish a new state registry, limiting sales to only FDA-approved products. Delegate Rodney Willet, a co-sponsor of the registry effort, believes it is “an important step to address childhood vape use.”

While Willet argues that the registry would still allow for the sale of numerous vape products, Midgette contends that the ever-changing popularity of brands in the industry makes it challenging to rely on a limited selection.

“It’s an evolving business. There’s one brand everyone wants, then a few months later people want a different one,” Midgette explained. “So, you’ve got to sell what’s popular.”

Concerns Over FDA Approval Requirements

Midgette also questioned the FDA approval requirement, suggesting that the products approved by the federal government represent a small and low-quality collection of brands that few consumers are interested in.

Proximity Restrictions for Vape Shops

Another bill, proposed by Delegate Alfonso Lopez, would prohibit the opening of new vape shops within 1,000 feet of schools or daycare centers.

“We’re finding that these vape shops and stores are popping up everywhere,” Lopez told Radio IQ.

Midgette acknowledged the abundance of vape shops in the Commonwealth, noting that his vape sales in Richmond suffer due to competition. However, he also pointed out a carve-out in Lopez’s bill for convenience stores and gas stations, questioning whether the legislation was truly about vape sales or the flashy neon signs that may have become an eyesore.

“If you’re making exceptions, you’re just trying to stop a store you don’t like to look at and that’s not a good, free-market practice,” Midgette argued.

Public Health Concerns and Overregulation

Lopez emphasized that the new rules were centered on addressing public health concerns, particularly in light of the World Health Organization‘s call for more restrictions on vapes.

“I worked in the Small Business Association and understand the problems with overregulating small businesses,” Lopez said, referencing his federal post during the Obama administration. “But weighing that against the impact vaping is having on kids; it’s the right thing to do.”

New Tax on Vape Products

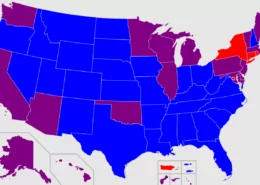

The Senate budget also includes a new six-cent-per-milliliter nicotine tax on vape products. Midgette dismissed the tax as insignificant, noting that North Carolina had already implemented a five-cent tax, which is handled by distributors before being passed on to consumers.

The tax has garnered bipartisan support, with Eastern Shore Republican Robert Bloxom proposing local authority to create a new tax on the product, although his bill was killed earlier in the session.

“I’m not sold vapes are not harmful, it’s like a cigarette,” Bloxom said, unfazed by the death of his bill but open to the budget language. “Therefore should pay the same cigarette-type tax.”

Vapers’ Perspectives

While Midgette doesn’t vape himself, those who do are equally unimpressed by the proposed rules. One anonymous vaper at the General Assembly Building suggested that the new regulations, including the FDA-approval rule, would have little impact on their use of the products.

“I’d rather have the company that’s been sued because they’ll be looking after their own product more,” the anonymous vaper joked, echoing Midgette’s assessment that the products’ dangers have little influence on users.

The vaper, who started vaping in high school at age 16, obtained their vapes from a gas station that didn’t bother to check ID. They also reported still seeing shops selling banned, flavored vapes with Canadian warning labels.

Legislators’ Rationale and Increased Oversight

Legislators argue that the new rules could prevent other kids from following the same path as the anonymous vaper. Additionally, the increased oversight included in Willet’s bill may help catch those violating tax or import laws.

Midgette stated that he would comply with any rules that are passed, but the vaper remains undeterred.

“Hell no,” they said when asked if the new rules would keep them from vaping in the future. “Why do you think I’m addicted?”

As Virginia lawmakers work to address the issue of youth vaping through new laws and taxes, vape shop owners and consumers express concerns over the potential impact on their businesses and personal choices. The debate surrounding the balance between public health and individual freedoms continues as the proposed measures make their way to the governor’s desk.

This report, provided by Virginia Public Radio, was made possible with support from the Virginia Education Association.

- Vaping Laws in Vermont : A Comprehensive Guide for 2025 - July 18, 2025

- Malaysian Sarawak Considers Banning Vape Product Sales - July 18, 2025

- FDA Authorized E-Cigarette List: What’s Really Included?(Updated July 2025) - July 18, 2025