Vaping Category Hits £1.2 Billion on Soaring UK Demand

The UK vaping market continues exponential growth, now topping £1.2 billion in 2023 sales driven by rising adoption among 4.3 million British smokers turning to reduced harm alternatives like disposables.

As consumer nicotine preferences diversify amid flavor innovation, reusable device eco-claims, and accelerating online sales, forecasts predict £1.4 billion UK vape category turnover by 2025.

4.7 Million UK Vapers As Smoking Alternatives Gain Traction

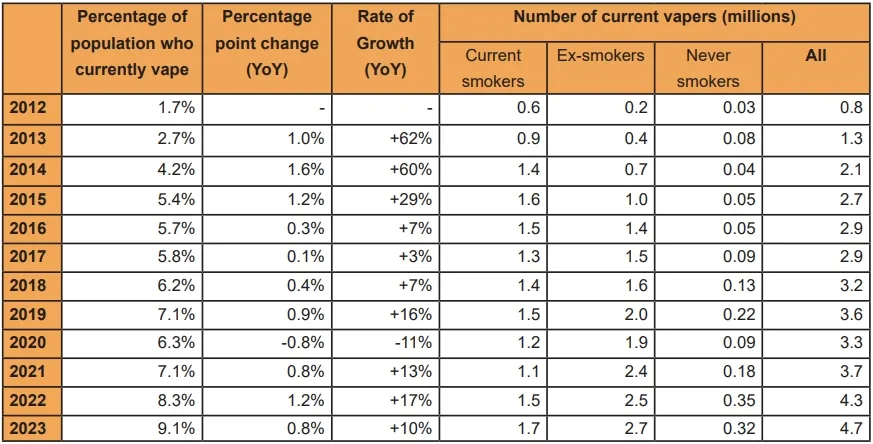

Over 4.7 million people now vape in Britain, up from 3.7 million in 2021 according to Action on Smoking and Health (Ash). As more smokers switch seeking safer nicotine options, insustry analysis shows the UK vape market size hit £1.2 billion this year.

Market researchers ECigIntelligence project continued momentum with £1.4 billion category value possible by 2025 if trends hold.

With volume sales in traditional retail already 35% of total vaping turnover, stores must dedicate sufficient fixture space to meet surging consumer demand says Imperial’s UK head of consumer marketing, Tom Gully.

Single-Use Options Ignite Disposables Growth

Simpler disposable vapes now dominate the UK, accounting for a staggering 83% national sales share according to 2022 data from the Independent European Vape Alliance.

The disposables segment alone saw meteoric rise recently – from £141 million in 2021 to over £973 million in 2022. This enormous growth underscores the importance for retailers to offer quality disposable ranges catering to latest consumer preferences.

Many vaping firms moved to capitalize on the single-use trend. Imperial Brands continues expanding their disposable blu lineup, while JUUL Labs UK data shows their simple pod-based devices commanding 55% of total closed system category sales.

Both argue their rechargeable models have advantages like lower lifetime environmental impacts when recycled properly – unlike entirely disposable rivals. But convenience and pricing remain key purchasing factors.

And with over 5 million disposables thrown out weekly in Britain, policy scrutiny also intensifies around enforcing responsible manufacturing according to waste reduction advocatesthe UK Government.

Although pod-based systems and open-tank formats retain steady 17% combined category share given their rechargeability and customization advantages. Gully says ensuring availability across multiple vaping formats optimizes retailer opportunities.

Flavor Diversity Key To Growth

While tobacco flavors satisfy nearly half of closed system vapers and broad nicotine experience claims attract many heated tobacco users, expanding taste profiles drive disposables turnover more akin to confectionary profiles.

Mint holds firm as the second most sought-after vape taste profile. However industry data shows fruit variants saw climbing demand over the past half-year across both disposables and closed pod systems.

Blueberry leads disposables flavor sales, while berry surged +60% month-over-month helped by new market entrants. This suggests innovation around safer nicotine products can still sway smokers if delivering more appealing user experiences.

In response, Imperial Tobacco launched expanded disposable options for its blu brand including Apple Ice, Tropical Mix and Mint Ice formulations. Combined, these characteristics accounted for 11% of past 6-month total UK vaping sales with doubling year-over-year share gains.

Read more:

Top 5 Blueberry Flavored Vapes

Increasing Popularity Of Online Retail

Many vapers now prefer online purchasing and auto-delivery subscription models versus in-store buying according to execs from both RELX International and heat-not-burn firm NEAFS.

Having robust e-commerce and omni-channel sales capabilities is becoming pivotal for merchants to capture this accelerating trend. Customer retention initiatives like loyalty programs also provide advantage during fluctuating consumer loyalty patterns.

RELX anticipates disposables remaining a contested area heading into 2023 among policymakers. But the consensus is tightening youth access and marketing codes through cooperation with responsible industry leaders will best serve public health goals.

Overall the UK vaping landscape is projected for robust near-term category expansion between £1.3 to £1.4 billion as recognized harm reduction potential continues convincing more adult smokers to switch. Retailers carrying diverse supply catering to latest consumer preferences and buying behaviors look poised to seize significant sales growth.

- Pakistan Punjab Bans Smoking and Vaping in All Parks and Gardens - July 30, 2025

- Ukraine Proposes Full Ban on E-Cigarettes with New Law - July 30, 2025

- Russia’s Legal Vape Liquid Producers Drop 23-Fold in a Year - July 30, 2025