$7 Billion Generated by Vape C-stores in the USA

As the premarket tobacco product application (PMTA) regulations transform the landscape, the vape industry finds itself navigating uncharted waters. Regulatory changes and uncertainties are creating challenges. However, some retailers choose to interpret these difficulties as opportunities instead of setbacks. They view this situation as a chance to adapt and innovate, finding ways to keep their businesses flourishing despite the obstacles.

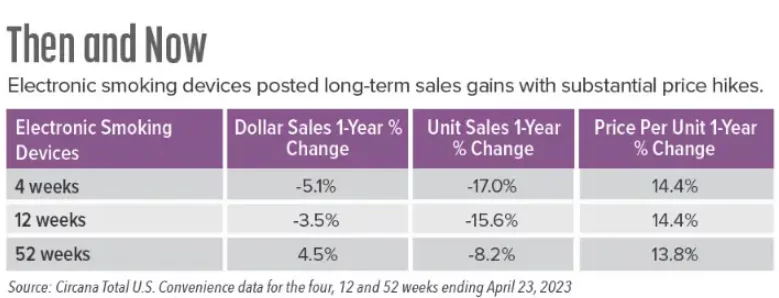

Circana, a market research firm, provides intriguing data that offers insight into this complex picture. From April 23, 2022, to April 23, 2023, electronic smoking devices — a category comprising e-cigarettes, vape kits, and mods — contributed nearly $7 billion to U.S. convenience stores’ bottom line. This figure isn’t something to be ignored. Indeed, over this one-year period, the vape industry experienced a dollar sales growth of 4.5%.

A Deeper Dive into the Data

While the big picture seems encouraging, delving deeper into the numbers reveals some less favorable trends. Both dollar and unit sales in more recent periods show a downward trajectory. Specifically, year-over-year dollar sales decreased by 3.5% in the 12 weeks ending on April 23. An even more significant drop of 5.1% was observed when the data was analyzed for a shorter four-week period. Furthermore, unit sales experienced sharp declines of 15.6% and 17% over the same respective periods.

The Bright Side

While the national statistics tell one story, individual businesses might tell another. On the local level, some retailers are actually seeing more favorable trends.

Consider Englefield Oil Co., for example. Nathan Arnold, the director of marketing, reported that their vape category has been performing strongly. “Our vape customers see us as a destination for their vape products, and also for other products that fuel their day. We continue to see basket building with this category, and promotional opportunities with brands have increased,” Arnold shared. Englefield Oil Co., with its headquarters in Heath, Ohio, operates a network of 119 Duchess convenience stores, and is also associated with fast-food franchises, commercial stations, and bulk warehouses.

Tim Greene, category director for general merchandise and tobacco at Smoker Friendly, similarly shares a positive account. He highlighted that “same-store sales are up 23% over a year ago as manufacturers continue aggressive pricing and promotional programs, which have been well received by consumers.”

The Other Side of the Coin

Despite the optimistic accounts shared by Arnold and Greene, not every story in the industry is as rosy. Many respondents to the Goldman Sachs “Q1 Nicotine Nuggets” survey, which represented around 65,000 retail locations, expressed concerns about the negative impact of flavored tobacco bans and damaging media attention on JUUL. They also noted that promotional activity remains consistent from the end of 2022 to the early months of 2023.

Spotlight on Emerging Trends

Nevertheless, amidst the array of challenges, the industry has its share of bright spots. Sales of disposable vape products are reportedly on the rise compared to other models in the subcategory. This growth is likely driven by the exemption of disposable e-cigarettes from the FDA’s 2020 ban on flavored vape products.

Currently, VUSE Alto is dominating this segment. NielsenIQ data reveals that sales for the 52 weeks ending April 8 surpassed $2.1 billion across all retail channels. This figure represents a substantial 36.8% increase in dollar sales, with volume also seeing a boost, rising by over 11% for the same period.

Preparing for Future Changes

Amidst all these ups and downs, the vape industry remains resilient. Retailers understand that changes are inherent in the business landscape and are part and parcel of the industry’s dynamics. They maintain a cautiously optimistic outlook, knowing that conditions can change at any moment. As a result, they continue to support the vape category, ready to navigate the ebb and flow of this complex industry.

Conclusion

The ongoing dialogue about the impact of vape on U.S. convenience stores’ revenue offers mixed insights. Yes, there are challenges — from regulatory shifts to negative media coverage. Yet, there are also opportunities, as shown by the upward trends in local markets and the resilience demonstrated by industry stakeholders. Therefore, it’s crucial for retailers to stay attuned to the evolving dynamics of this industry, always ready to adapt and innovate.

- Teen Vaping of THC & Synthetic Cannabinoids Surges: Study - July 4, 2025

- UK Wolverhampton Extends “Swap to Stop” Vape Program - July 4, 2025

- Pakistan Halts Vape Crackdown Pending Legislation - July 4, 2025