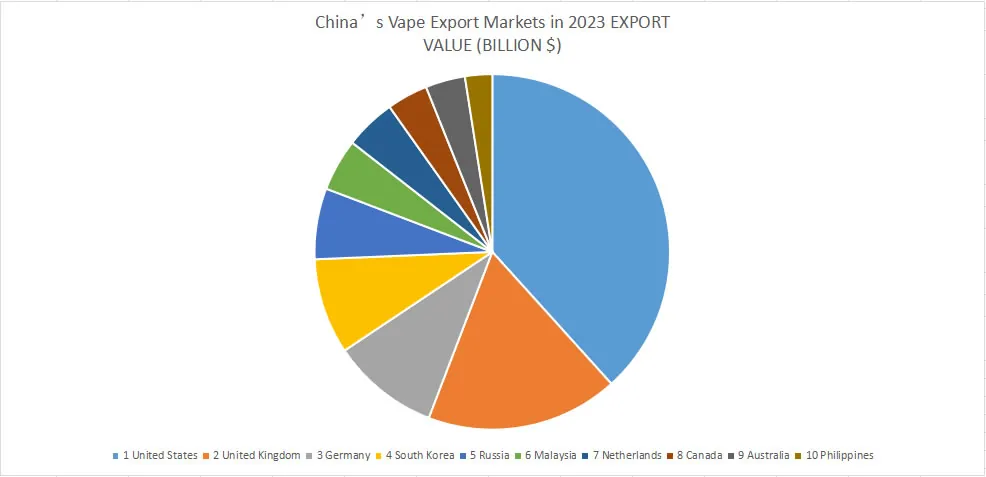

China’s Vape Exports Surged in 2023 – Top 10 Markets

China solidified its standing as the foremost global exporter of vaping products in 2023. Total export value reached $110.84 billion, a 12.5% increase over 2022. The top 10 destination markets highlight rising international demand alongside China’s manufacturing leadership.

Surging Chinese Vape Exports In 2023

China’s vape export value jumped to over $110 billion last year, underscoring steady category growth. As both innovation hub and factory floor for hardware manufacturing, China supplies vaping products to major developed markets and emerging economies alike.

Driving this export success is China’s unparalleled infrastructure for scaled production of vape devices, e-liquids, and components. Established supply chains also enable agile responses to international regulatory shifts.

For businesses worldwide, understanding China’s export landscape provides strategic insight into the future complexion of the global vape market.

The United States And United Kingdom Lead China’s Export Markets

The two largest importers of Chinese vape products remain the United States at $31 billion and the United Kingdom at $16 billion. These figures reveal the still heavy reliance on China as the manufacturing origin for major Western vape markets.

However, relative market share decreased slightly for the U.S. and U.K. year-over-year as other countries posted higher growth percentages. This indicates gradual diversification of supply chains in select regions.

Top 10 Import Destinations Claim Over 70% Market Share

Table: China’s Vape Export Markets in 2023

| RANK | MARKET | EXPORT VALUE (BILLION $) | MARKET SHARE | YEAR-OVER-YEAR GROWTH |

|---|---|---|---|---|

| 1 | United States | 31.01 | 27.98% | +0.40% |

| 2 | United Kingdom | 14.17 | 15.49% | +17.99% |

| 3 | Germany | 7.94 | 7.16% | +28.48% |

| 4 | South Korea | 7.05 | 6.36% | +35.32% |

| 5 | Russia | 5.22 | 4.71% | -0.76% |

| 6 | Malaysia | 3.85 | 3.47% | +22.61% |

| 7 | Netherlands | 3.76 | 3.39% | +46.30% |

| 8 | Canada | 3.02 | 2.72% | -0.66% |

| 9 | Australia | 2.92 | 2.63% | +47.47% |

| 10 | Philippines | 2.00 | 1.80% | +146.91% |

The top 10 importers accounted for approximately 73% of China’s total vape export value. This concentration reveals established trade channels to major strategic markets that Chinese manufacturers likely nurture through preferential pricing and supply assurances.

However, the outsized growth story resides with the Philippines. Its vape imports from China expanded by over 52% in 2023, the largest percentage increase among top 10 markets by a wide margin.

Emerging Markets Gain Steam Outside Established Strongholds

While the U.S. and Western Europe represent entrenched vape markets relying heavily on China’s output, developing economies gained notable ground:

Fastest Growing China Vape Import Markets (2023)1. Philippines - 52.8% import growth2. South Africa - 38.2%3. United Arab Emirates - 29.7%4. Saudi Arabia - 27.1%5. Argentina - 25.0%Rising disposable incomes in these regions likely contribute to vaping adoption rates. And as more first-time vapers enter these markets, China supplies the budget-friendly devices to meet surging demand.

Argentina’s heavy tobacco smoking rates present a prime target for vape conversion. Over 25% annual import growth from China signals aggressive vape market strategies are already underway there if not across Latin America.

The outlook may call for China focusing more export resources on emerging markets exhibiting outsized expansion.

Key Takeaways: China’s Vape Export Dominance Solidifies

The 2023 trade data reaffirms several themes around China’s global vape impact:

- Total export value reached record levels on continued double-digit growth

- The United States and United Kingdom remain uphill battles for competing manufacturing hubs

- Top importers point to entrenched trade channels and supply chain relationships

- Developing economies led by the Philippines gained significant steam

For vape brands worldwide, both opportunities and threats reside in China’s export depth. Understanding the trends can inform strategies around manufacturing, targeted markets, and regulatory activity.

- UK Wolverhampton Extends “Swap to Stop” Vape Program - July 4, 2025

- Pakistan Halts Vape Crackdown Pending Legislation - July 4, 2025

- Wisconsin New Law Banning Sale of Most Vape Products - July 4, 2025