Nebraska Proposes 20% Tax on Vapes and Nicotine Alternatives

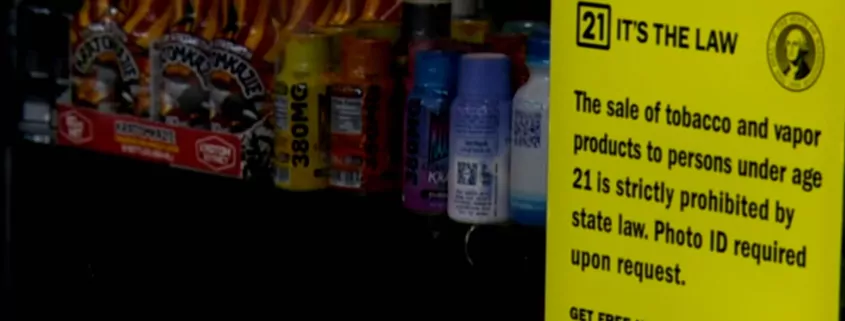

Nebraska State Senator Jana Hughes has introduced LB 125, a bill that seeks to impose a 20% sales tax on alternative nicotine products and electronic nicotine delivery systems (ENDS). The legislation aims to bring these products under the same regulatory and taxation framework as traditional cigarettes and other tobacco products.

“Most people realize these products aren’t excise taxed right now. They contain nicotine, so why should they get a pass? Vapes, cigarettes, and tobacco patches are all taxed,” Hughes stated, emphasizing the need for consistency in nicotine product taxation.

Addressing Loopholes in Nicotine Regulation

The bill also targets Delta-8, a chemically altered form of marijuana that some argue should not fall under nicotine regulations due to its modified chemical structure. Hughes clarified her stance with LB 9, a separate bill that ensures any nicotine analogue—substances with altered molecular structures but similar effects—will remain subject to excise taxes.

“LB 9 ensures that any nicotine-like substance, even if chemically altered, will still be taxed. This closes potential loopholes in the current system,” Hughes explained.

Why the Tax?

Hughes highlighted the growing variety of nicotine-related products and the lack of taxation on alternatives as key reasons for the bill. “The market is flooded with new products, and many of them aren’t taxed. This creates an uneven playing field and misses out on potential revenue,” she said.

If passed, the new tax would take effect on January 1, 2025, impacting manufacturers, retailers, and consumers of vaping devices, e-liquids, and other nicotine alternatives.

- Is It Illegal to Vape or Smoke While Driving in Massachusetts? - August 5, 2025

- Austria Plans to Ban Disposable E-Cigarettes - August 5, 2025

- Vaping vs. THC Drinks: Which Cannabis Option Is Right for You? - August 4, 2025