Canada Vaping Taxation Framework Targets High Youth Rates

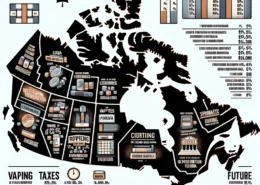

The Department of Finance has released draft regulations to expand Canada’s coordinated vaping taxation framework, aiming to curb the alarmingly high vaping rates among young people in the country. The proposed regulations would enable Alberta, Manitoba, New Brunswick, Yukon, and Prince Edward Island to join the existing framework, which already includes Ontario, Quebec, the Northwest Territories, and Nunavut.

Increased Excise Duty Rates and Revenue Sharing

In Budget 2024, the government announced a 12 per cent increase in vaping excise duty rates, equivalent to 12 cents per typical vape pod in a non-participating jurisdiction and 24 cents in a participating one. This increase is set to take effect on July 1, 2024, coinciding with the implementation of the coordinated taxation regime in the four existing participating jurisdictions.

Under the framework, total revenues will be divided equally between the federal and provincial/territorial governments, ensuring a collaborative approach to addressing the issue of youth vaping.

Draft Regulations Amending the Excise Duties on Vaping Products Regulations

Combating the Rise of Youth Vaping

The government’s efforts to tackle the growing trend of vaping among younger Canadians were first highlighted in Budget 2021, which introduced the new taxation framework for vaping products. Recent data from the 2022 Canadian Tobacco and Nicotine Survey underscores the urgency of this issue, revealing that younger Canadians are significantly more likely to have ever vaped compared to the national average.

Public Consultation and Feedback

To ensure a comprehensive and inclusive approach, the government invites all Canadians and stakeholders, including Indigenous governments, organizations, and associations, to provide feedback on the proposed regulations by emailing [email protected] by July 22, 2024.

Excise Stamp Requirements and Implementation Dates

Dutiable vaping products must bear an excise stamp indicating that duty has been paid. Starting July 1, 2024, vaping products destined for the duty-paid market of participating jurisdictions must bear a province- or territory-specific excise stamp. This requirement will extend to Alberta, Manitoba, New Brunswick, Yukon, and Prince Edward Island beginning January 1, 2025, pending the implementation of the Coordinated Vaping Products Taxation Agreement in these provinces and territories.

The Canada Revenue Agency and the Canada Border Services Agency will be responsible for the collection and administration of vaping product excise duties within Canada and on imported products, respectively.

As the government continues its multi-faceted approach to address the concerning trend of youth vaping, the coordinated taxation framework and the proposed draft regulations represent a significant step towards protecting the health and well-being of young Canadians.

News source:

Government releases draft regulations on coordinated vaping taxation framework

- Australia to Limit Vape Sales to Pharmacies from Next Week - June 25, 2024

- North Handshake 15000 Puffs Disposable Vape Review - June 25, 2024

- UAE Vaping Regulations: Is Vaping Legal in the UAE? - June 25, 2024