Maine Governor Proposes 50% Tax Hike on Cigars and Tobacco Products

On Friday(01/10/2025), Maine Governor Janet Mills unveiled her biennial budget proposal, which includes a significant increase in the state’s tobacco taxes to balance spending with revenue. The governor aims to raise the cigarette tax from its current rate of $2 per pack, which was last adjusted in 2005, to $3 per pack. Maine currently has the lowest cigarette tax, the highest adult smoking rate, and the second-highest youth smoking rate in New England, which Governor Mills cites as justification for the proposed tax hike.

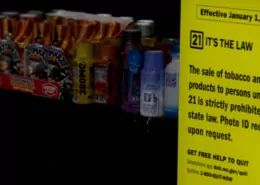

According to state law, when the cigarette tax is adjusted, the tax on other tobacco products (OTP) must increase by a corresponding rate. Consequently, if the governor’s proposal is approved, the tax on cigars will rise from 43% to 65% of the wholesale sales price. This rate will also apply to chewing tobacco, e-cigarettes, and any other product made or derived from tobacco or containing natural or artificial nicotine.

For a cigar with an MSRP of $9.50, the price at the register would increase from an estimated $13.59 to $15.68, excluding any additional sales taxes. This increase would position Maine as having the fourth-highest cigar tax rate in the country, behind only Utah, New York, and Alaska.

Supporting documents for Governor Mills’ proposal indicate that the tobacco tax increase, if approved, would generate approximately $80 million in revenue for the state’s general fund over the next two years. The governor opted to pursue the tobacco tax increase rather than seeking to raise the state’s general sales tax or income tax.

The governor’s proposal must still navigate the legislative process, and it remains uncertain whether state legislators will be receptive to the proposed increase. If the legislature adopts the proposal as written, the tax hikes would take effect on January 5, 2026.

As the debate surrounding the proposed tobacco tax increase unfolds, stakeholders in the cigar and tobacco industry will closely monitor its progress and potential impact on their businesses and consumers.

- Russia’s Vape Market: Inside the Battle for Control - August 8, 2025

- Brazil: Paraná Bill to Add Vaping to “No Smoking” Signs - August 8, 2025

- Celebrate with EightVape: 10 Lucky Winners Get Free Orders or $100 Gift Cards - August 8, 2025