Vaping Laws in Rhode Island: Is it Legal to Vape in Rhode Island?

Known for its picturesque coastline and rich history, Rhode Island has also become known for enacting some of the most stringent vaping regulations in the United States. This guide provides an in-depth look at Rhode Island’s current vaping laws, unpacking the details of what’s legal, what’s changed, and what you need to know to navigate this tightly controlled landscape.

Is Vaping Legal in Rhode Island?

Yes, vaping is legal for adults aged 21 and over in Rhode Island. However, the state has implemented a comprehensive ban on the sale of flavored vaping products (with limited exceptions) and imposes strict regulations on sales, public use, and taxation, making it one of the more restrictive states for vapers and vape businesses.

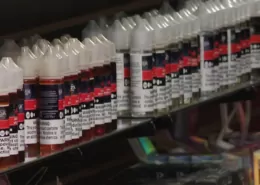

The Flavor Ban in Rhode Island

The most impactful piece of recent vaping legislation in Rhode Island is the comprehensive ban on the sale of flavored electronic nicotine-delivery system (ENDS) products, which took full effect on January 1, 2025. This law, which codified and strengthened a 2019 executive order, prohibits the sale, offer for sale, or possession with intent to sell any flavored ENDS product in the state.

What’s Banned and What’s Allowed?

The law defines a “flavored electronic nicotine-delivery system product” broadly as any ENDS product that imparts a characterizing flavor or aroma. This includes, but is not limited to, flavors of fruit, mint, chocolate, honey, spice, or products that create a cooling or numbing sensation. The ban applies to both face-to-face retail sales and online sales targeting Rhode Island residents.

The only explicit exemptions under the current law are:

- Tobacco-flavored vaping products.

- Unflavored vaping products.

- Menthol-flavored e-cigarettes, which were specifically exempted in a June 2024 legislative update, allowing their sale to resume from January 2025.

There is also an exemption for licensed compassion centers and cannabis cultivators, but this applies only to their cannabis products, not to any products containing tobacco or nicotine.

Ecigator is one of the well-known vape brands spun off from FM Technology Co., Ltd, it’s an ISO-certified disposable vape manufacturer for OEMs, ODMs, and OBM since 2010. The founder team comes from top firms with more than 10 years of experience in the vaping industry and has devoted thousands of hours to providing users with a better and better experience.

18K Disposable Pod Kit

Disposable Pod Kit – 18ml changeable pod with 650mAh rechargeable battery.

20K with Large Screen

20000 Puffs Disposable Vape with large screen. Normal and Boost working modes.

20K DTL Disposable

20K Puffs DTL(Directly to Lung) disposable vape with airflow control and screen.

Age Restrictions and Sales Regulations

Rhode Island maintains strict age-related laws to prevent youth access to all nicotine and vapor products.

Minimum Legal Sales Age: Strictly 21

The minimum age to purchase, possess, or use any electronic nicotine-delivery system (ENDS) product in Rhode Island is 21 years old. This aligns with the federal “Tobacco 21” law. It is illegal for anyone under 21 to purchase or publicly possess vaping products.

Retailers are mandated to verify the age of any purchaser who appears to be under 30 years old by checking a valid government-issued photographic identification.

Retailer Licensing Requirements

All businesses selling vaping products in Rhode Island must obtain the proper licenses. As of January 1, 2025, the administration of ENDS licenses transferred from the Department of Health to the Rhode Island Division of Taxation. The licensing structure includes categories for distributors, manufacturers, importers, and dealers (retail and vending machine operators). A separate license is required for each business location and each vending machine, with an application fee of $25 and annual renewal.

A crucial compliance point is that retailers can only purchase ENDS products from distributors, manufacturers, or importers who hold a valid Rhode Island license. This is designed to ensure proper tax collection and a controlled, compliant supply chain.

Sales Practices and Packaging

- Vending Machines: Vaping products can only be sold through vending machines in adult-only (21+) facilities where minors are not permitted entry.

- Packaging: E-liquid must be sold in child-resistant packaging to prevent accidental ingestion by children. Products must also be sold in their original, factory-wrapped packaging without modification by the retailer.

Taxation of Vaping Products in Rhode Island

Rhode Island implemented a new tax structure on vaping products, effective January 1, 2025. The state uses a tiered system:

- Closed System Products (prefilled, non-refillable, e.g., disposable vapes, pods): Taxed at a rate of $0.50 per milliliter of e-liquid.

- Open System Products (refillable devices and bottled e-liquid): Taxed at 10% of the wholesale cost.

These excise taxes are in addition to the standard 7% state sales tax and are intended to generate revenue for public health initiatives while discouraging use through increased cost.

Furthermore, the Rhode Island House of Representatives has proposed an 80% wholesale tax on nicotine pouches, which, if approved, would take effect on October 1, 2025, indicating a broader move to tax all alternative nicotine products heavily.

Where Vaping is Prohibited in Rhode Island

Rhode Island’s Clean Indoor Air Act treats vaping identically to traditional smoking, prohibiting its use in most indoor public spaces and workplaces. This ban, which was extended to vaping in 2018, covers a wide array of locations:

- Private businesses and all indoor workplaces.

- Restaurants and most bars.

- Public restrooms and shopping malls.

- Common areas of apartment buildings with more than four units.

- All K-12 school properties (both indoor and outdoor).

- Healthcare facilities.

- Public transportation.

Limited exceptions exist for certain establishments, such as vape shops that derive at least 33% of their revenue from electronic tobacco devices and do not sell food or beverages.

Enforcement and Penalties

Rhode Island enforces its vaping laws through the Division of Taxation and local law enforcement, with significant penalties for violations. The U.S. FDA also conducts its own compliance checks.

- For Retailers: Penalties for violations (such as selling flavored products or selling to minors) are severe and escalate with subsequent offenses:

- First violation: $250 fine.

- Second violation: $500 fine.

- Third violation: $1,000 fine plus a 14-day license suspension.

- Fourth and subsequent violations: $1,500 fine plus a 90-day license suspension.

- Enforcement Actions: Law enforcement agencies are actively conducting compliance checks. In 2024, for example, the East Providence Police Department confiscated over $22,000 worth of illegal flavored vaping products during compliance operations.

Conclusion:

Rhode Island has established one of the most comprehensive and restrictive regulatory environments for vaping in the United States. While the laws aim to protect public health and curb the youth vaping epidemic, they face ongoing legislative and legal challenges from those who argue they are overly restrictive and harm small businesses and adult smokers seeking less harmful alternatives. As these debates continue, the regulatory landscape in the Ocean State will likely see further evolution, making it essential for all stakeholders to stay informed and compliant.

References

- RI Division of Taxation – Electronic Nicotine-Delivery System (ENDS) Tax

- TurnTo10 – What to know about Rhode Island’s flavored vape ban (Jan 2025)

- RI Division of Taxation – Notice 2024-04: ENDS Flavor Ban (PDF)

- RI Department of Health – Banning the Sale of Flavored ENDS (PDF)

- BillTrack50 – Rhode Island S0543 (Vape Shop Exemption Bill)

- HHC Vapes: What Are They & Are They Safe? - July 31, 2025

- Cannabis and Vape Shop Workers Rank Happiest in Nation - July 31, 2025

- Richmond, VA, Restricts New Vape & Tobacco Shop Locations - July 31, 2025