What’s Next for Disposable Vape Giants After UK Ban?

The recent ban on disposable vapes in the UK will significantly impact the e-cigarette trade between China and UK. Leading brands like ELFBAR, SKE, and Lost Mary will take the initial brunt. How will the market “giants” be affected and respond?

On January 29th, UK government suddenly announced a total disposable vape ban after months of rumors and speculation.

As the second largest vape market after the US, China exported over $1.4 billion vape products to the UK in 2023. Though exact figures are unavailable, disposable vapes likely comprise the majority based on market conditions and industry feedback.

The abrupt ban will seriously affect China-UK vape trade. The blow will first be felt by top brands like ELFBAR, Lost Mary, and SKE Crystal – known as market leaders.

Disposable Ban Hits Leading Brands Hardest

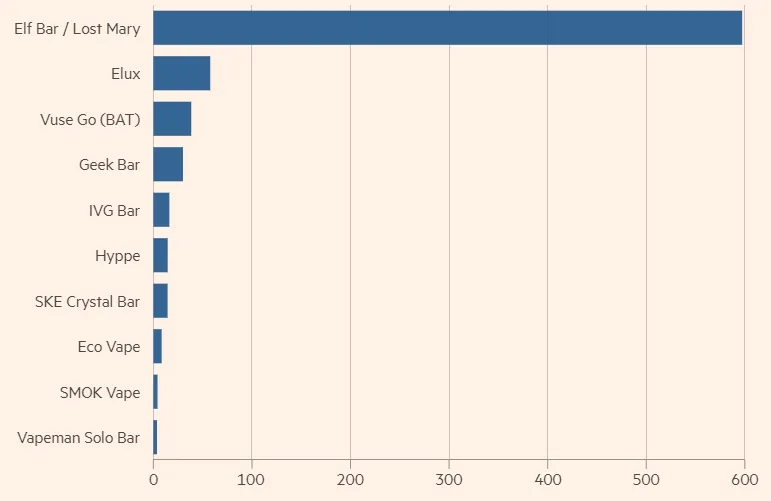

The UK vape market exhibits oligopoly characteristics. ELFBAR and Lost Mary accounted for 50%+ of all disposable vape sales in UK in NielsenIQ’s January and April 2023 rankings – firmly in top tier.

SKE experienced phenomenal 2023 UK growth as a rising star. Parent company SKE’s H1 revenue exceeded $1.4 billion, up 1,477% YoY – becoming #2 brand in UK after ELFBAR. At one point, some even believed SKE overtook ELFBAR as the disposable leader.

Before the ban, ELFBAR, Lost Mary, and SKE Crystal firmly dominated – their oligopoly strengthening amid disposable ban rumors in September 2022. Distributors only bought these “Big 3” brands to avoid excess stock.

However, the giants benefiting most, will now suffer most.

SKE Faces Bigger Blow

Many believe SKE will lose more than ELFBAR and Lost Mary. UK is SKE’s primary battlefield. Second largest market Netherlands has smaller volume unable to support SKE’s exports. At $370 million in 2023, Netherlands figures include transit trade – actual market likely much smaller.

SKE performs poorly in other key markets like US, Russia, and Germany. High UK dependence leaves SKE very vulnerable.

In contrast, ELFBAR and Lost Mary enjoy market leadership in US, Russia, Southeast Asia etc alongside UK. Lower UK reliance provides buffer.

First Movers in New Product Categories

Anticipating uncertainties over UK’s disposable regulations, giants explored alternatives in early 2023.

In May, ELFBAR launched vape liquid brand ELFLIQ in Italy. In June – replaceable pod system ELFA in Spain. And in August – ELFA PRO in UK. At October Birmingham vape show, Lost Mary exhibited replaceable pod and vape juice products too.

In October, SKE Crystal Plus pods and SKE vape juice also debuted.

Notably, second half of 2023 saw many disposable brands enter UK’s booming vape juice market, including VUSE, ELUX and even distributors like E-SHEESH. Seeking to lead vape juice like they did disposables.

Ecigator Sticky Prefilled Pod Kit

The Ecigator Sticky Prefiiled Replaceable Vape Pod Kit is new kind of vape kit which the prefilled disposable pod can be changed.

That means you don’t need to throw away the whole kit but just change another pod. Also you can change the pods to taste different flavors.

Mixed Results So Far

However, industry sources suggest replaceable pod sales remain lackluster in UK.

An insider said ELFA PRO struggles against more cost-effective illicit “Large Puffs” products. Low demand from retailers and distributors due to less profit potential. Though sales data unavailable for Lost Mary and SKE’s replaceables, they appear scarce in stores too.

Bright spot is ELFA PRO entering UK supermarkets in September. Wide distribution provides sales boost over vape shops.

Unlike replaceables, vape juice market exhibits strong growth in UK – brands faring better here. But disposable giants yet to demonstrate market leadership seen previously.

ELUX the current runaway leader based on sources. Potentially selling 3 million 10ml bottles monthly after pivoting from disposables origin like giants.

Can Giants Capitalize on Emerging Open Pod Systems?

As giants built replaceable pod presence, open pod systems unexpectedly took off after disposable ban rumors began per UK vapers. Completely overshadowing replaceables in growth.

Prominent UK distributor websites currently focused on pushing new vape juices and open pod systems over replaceables too.

Among open pod brands, OXVA most popular currently. As giants scrambled to ready replaceables, OXVA quietly rose with open pods – catching industry off guard.

Robert Sidebottom of UK compliance firm ARCUS suggested Chinese firms evaluate open pod market, with disposable ban just announced as open pods heat up quickly.

Ecigator Sticky Open Pod Kit

The Sticky Open Pod Kit is a contemporary vaping device that combines functionality with fashion. This kit is designed with a box-style form factor, offering a compact and stylish appearance that’s ideal for vaping enthusiasts on the move.

At the heart of this kit is a Refillable Open Pod System, with a capacity of 2ml, perfect for accommodating a variety of e-liquids. The pod is equipped with a high-quality Mesh Coil that not only ensures a rich and flavorful vaping experience but also boasts durability for up to 8 Refills.

But an insider revealed technical barriers for disposable players in more complex open devices. Also different business models. So no clear advantage for disposable brands pursuing open pods – uphill battle.

Notably though, ELFBAR parent company iMiracle connected to open pod via affiliate GEEKVAPE – acquired by iMiracle owner from OXVA parent. If ELFBAR enters open pods, existing expertise via affiliate provides head start over rivals.

With disposable ban not officially enacted yet, UK vape market direction remains unfolding. We will keep monitoring market dynamics.